Years ago, I complained to my friend Stirling Newberry that the unemployment rate didn’t seem to track how good the economy felt, or how many people were in desperate need of employment.

The unemployment rate was, then, and is now, taken as a proxy for the health of the economy for ordinary people. However, I could see and feel that the economy was getting worse for ordinary people, and that fact was showing up in other statistics. Plus, unemployment rates that were considered a crisis when I was young in the 70s, were now considered acceptable.

(See: The Economy Has Not Recovered, With Graphs)

Stirling said, “You need to know who an economic statistic is designed for, and what they use it for.”

A little history is necessary here, about inflation. In the 70s, due to the oil crisis and other mishandled economic problems, inflation got out of control in the West. Very high interest rates were used to bring it down, by Chairman Volcker at the Fed. Western policy makers became obsessed with inflation. It was considered Enemy Number One. They decided that the worst cause of inflation was wage increases and called this “wage push inflation.”

To track this, they turned to a statistic called the non-accelerating inflation rate of unemployment (NAIRU). NAIRU was the rate below which the unemployment rate was assumed to cause inflation.

The unemployment figure measures the number of people actively looking for jobs, compared to those who have jobs, remember. Thus it measures the active demand, in the market, for a job. Therefore, theoretically, if there are too few people looking for jobs, employers are expected to have to raise wages to attract workers.

(This is, to be clear, when wages rise the most, which is something non-economists and non-oligarchs want to happen.)

If you are old enough, you will remember that during the 80s and 90s, and even into the 00s, when the unemployment rate would drop, the stock market would take losses. This is because stock investors expected the Federal Reserve to raise interest rates, which is bad for the economy and bad for stocks.

So, the unemployment rate from late 70s and on, has been used to determine if wages should cause inflation, and to then raise interest rates to make sure they don’t.

Not incidentally, the result is also to crush wages, because, essentially, wages that improve are nothing more than wages that increase faster than non-wage inflation.

The unemployment rate not only doesn’t measure how good the economy feels for ordinary people, it was actually used, with purposeful action, to crush wages.

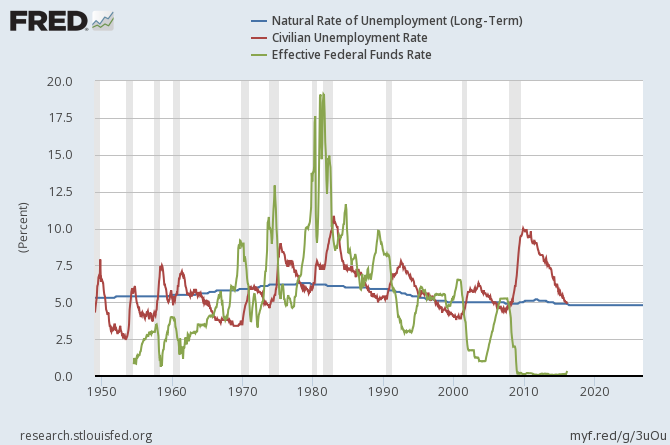

You’ve all been waiting patiently for your pretty graph, so here it is.

NAIRU (Civilian Unemployment Rate) vs Unemployment (Natural Rate of Unemployment) vs Effective Federal Funds Rate

You’ll notice that while effective federal funds rates (the green line) increase during low unemployment periods (the red line) before Volcker, it is after Volcker that they correlate strongly to whether the unemployment rate is approaching or below NAIRU. Before Volcker, the unemployment rate is often below NAIRU and people get a lot of raises.

Note, in particular, and with amusement, that the flat, blue line rate (the natural rate of unemployment) in recent years shows a period where unemployment has stayed above NAIRU. Note that Yellen started talking about increasing rates as the unemployment rate came closer to NAIRU.

Your wages were crushed, deliberately, supposedly to crush wage inflation.

And this is why unemployment doesn’t have very much to do with how the economy feels for ordinary people, especially not now (it effects how the economy feels some, but not much). Unemployment has to get below NAIRU and stay there for you to get real wages.

I will point out, for completeness, that the idea that wages are the most important source of inflation is questionable, but I’ll deal with that at a later date.

(Read: A More Detailed Look at the End of the Post-war Liberal Era)

Originally published Feb 17, 2006. Back to the top because it is an actually important post. We just recently had another case of the stock market declining due to low unemployment rate figures. This is why.

The results of the work I do, like this article, are free, but food isn’t, so if you value my work, please DONATE or SUBSCRIBE.

S Brennan

Good Post Ian;

I mention in passing, [because you already know], Jimmy Carter elevated Paul Volker, NOT REAGAN. Until the left understand what happened in the 70’s they are powerless.

Greg T

There are many economic sectors where inflation is high that has nothing to do with higher wages. Education, particularly higher education is one example. Inflation has been running at7% since at least the mid-80s. Health Care is another. Inflation rates are about the same over a similar period. Cell phone service is inflating at an insanely high rate. The list goes on.

That never seems to show up in inflation measures.

Spinoza

“Natural Rate of Unemployment”…what a revealing turn of phrase.

John Poynton

In the UK the situation has been complicated by the government’s determination to reduce the cost of welfare, which has led to lots of people being reclassified as self-employed when in fact they are not earning a penny. Lots more have been sanctioned off benefits because they failed to look hard enough for jobs which weren’t there. So we have an apparent unemployment rate pretty much on NAIRU, but no sign of inflation and tax revenues well below forecast!

EmilianoZ

There was a very interesting post at NC that said that the main purpose of a large unemployment rate was to discipline the workers. Employers usually find that they cant effectively discipline their workers when they can just leave and get another job. The post went on to say that there’s only one condition under which employers would tolerate full employment: when the workers are disciplined by fascism. That was a post about Trump.

Unemployment has plenty of useful features for our lords and masters.

A1

It is funny that having lived in Alberta where recently we really did have a 4% unemployment rate we had the following:

-help wanted signs everywhere

-new university graduates from around the country

-people getting raises and bonuses at all income levels in all types of jobs

-long waits for anything involving a trade

-lousy service in fast food places

-lots of mobility upwards – last weeks busboy is today’s waiter is tomorrows manager

-people making enough money to live their dreams

This type of activity was noticed everywhere. You had things like the City of Edmonton not performing maintenance because there were not people available to perform the work.

During my travels to the US Cities where the unemployment rate is supposedly 4% I have never noticed the broad based boom like in Alberta. Maybe I did not go to the right places, and the plural of anecdote is not data, but there should be some outward signs of a tight labor market.

Unfortunately us Albertans will not have to worry about this until the next boom. In the meantime the last person out will get to turn the lights out…….

Hugh

What S Brennan is referring to is that Carter not only appointed Volcker but the following also occurred during his Presidency:

1978 Airline Deregulation Act deregulating the airlines

1978 Civil Service Reform Act set up the Federal Labor Relations Authority to oversee collective bargaining with federal workers. It was this entity which Reagan used to decertify Patco in 1981

1980 The Depository Institutions Deregulation and Monetary Control Act repealed usury limits on what banks could charge in interest

Motor Carrier Act of 1980: deregulated trucking

When I chart the foundation and construction of the present kleptocracy, this is why I place its origins in the Carter Administration.

Ian is correct that since Volcker the primary mission of the Fed has been to crush wage growth and it has been very successful in doing so. As productivity increased since this time and real wages did not, the wealth that increased productivity represented flowed, not to workers but the 1%, and represents one of the largest transfers of wealth in history.

The Fed was not, however, the only agent of this theft. The destruction of unionism was also important. I track the demise of unionism back to the Red Scares of the Wilson (a liberal) era which effectively cut unions off from the larger social movements which fed and protected them and were necessary for their long-term survival. It took decades, but with their broader social activism gone, they became institutionalized, and ossified This allowed them first to be isolated, challenged and then destroyed. You have only to look at the SEIU endorsement of a pro-corporatist candidate like Hillary Clinton or the waffling and ineffectuality of Trumka to see just how far unionism has fallen and betrayed itself.

Then there is offshoring. Why raise the pay of an American worker, when you can send her and his job to China, Vietnam, or Bengladesh, abuse the workers there more and pay them much, much less? Sure, the quality (and often the safety) control goes to hell, this is why the new normal is a flood of cheap, crappy, and sometimes dangerous products, but an added plus is that the threat of offshoring helps depress wage increases for jobs that aren’t (or haven’t yet) been exported.

Finally, there is inshoring. It says so much about the decadence of our times that the billionaire Trump rants against illegal immigration when so many of those who built his grandiose monuments to the rich and staff them are the very illegals he rails against. Whole sectors like agriculture, meat packing, hotels, restaurants, and construction depend on illegals. Again these workers can not only be paid less and treated worse than American workers. They also have a depressive effect on wages of Americans still in these industries and more broadly on wages in the economy in general. Trump doesn’t need to build a wall alog the Rio Grande. All he needs to do is heavily penalize the employers of illegals, you know, like himself.

Billikin

“To track this, they turned to a statistic called the non-accelerating inflation rate of unemployment (NAIRU). NAIRU was the rate below which the unemployment rate was assumed to cause inflation.”

The NAIRU is not a statistic. It has never, repeat, never been measured, or shown to exist. If the unemployment rate falls below the supposed NAIRU, it is supposed to cause not only inflation, but accelerating (hyper) inflation. That is patently absurd. You have to make some ridiculous assumptions to think that.

Hugh

I have stopped looking at the unemployment rate because I think the active job seeker model reflects a kind of economy that doesn’t exist. You get this in the BLS data where parameters which made more sense in the 1940s and 50s are still used for purposes of continuity. On the other hand, some innovations (wages) in recent years have been used to make the economy look better by mixing in higher wage employees. I would also note that the unemployment rate is figured out of the household survey, the smaller of the two surveys used in the monthly jobs report, and its 90 percent confidence level is something like 500,000, that is a figure from the household survey is within 500,000 of whatever it is measuring, –its definition for unemployment for example.

I wanted to say, from the establishment survey which I do look at, February was a very good month for jobs: 760,000, seasonally unadjusted, if I remember correctly. March wasn’t as good, 600,000 (but in line with previous Marches). So taking the two together, 2018 is still ahead of other recent years by 200,000. However, this year’s December-January drop in jobs was 200,000 larger than usual. In other words, so far, this year is really much like other years, just with more volatility. For me, this is why there was a pullback in the March officials figures. The BLS overshot and thought the economy was doing better than it was.

Billikin

NAIRU is not a statistic. It has never been measured. It is always assumed.

Frank Stain

@EmilianoZ: That theory comes from Michael Kalecki’s 1943 paper, ‘Political Aspects of Full Employment’. Kalecki detailed systematically what Ian grasps in this post, namely that unemployment and inflation policy in an advanced capitalist economy are essentially political rather than economic tools. Opposition to full employment is a way of disciplining workers, making it less likely that they will be able to use the power of the strike effectively to improve wages and working conditions. Unemployment must therefore be a normal part of the capitalist system because otherwise the power of workers to press for wage increases would threaten profits.

Altandmain

Ian, the reason why is because there is an incorrect hypothesis – the Phillips Curve that hypothesized that there was a relationship between inflation and unemployment. The idea was that would keep inflation low. Naked Capitalism has an article on why it is incorrect, but has caused tremendous damage to society.

@EmilianoZ

That was my post.

Here is the exact quote.

https://mronline.org/2010/05/22/political-aspects-of-full-employment/

After WW2, when Michal Kalecki joined the UN and lived in New York, he was denounced during the McCarythist era as a Communist.

The point though remains clear. This is not about profits – this is about the boss dominating the rest of us “little people”. They are not chasing profits, but relative power over the rest of us.

@A1

There were places in the US encountering their oil booms. They had striking similarities to Fort McMurray.

You cannot compare the American and Canadian unemployment rates. This is quite apples to oranges. For more details, please see:

https://milescorak.com/2012/05/04/the-gap-between-us-and-canadian-unemployment-rates-is-bigger-than-it-appears/

Actually even the Canadian version of unemployment understates the true figures.

See:

https://www.theglobeandmail.com/report-on-business/economy/economy-lab/canadas-unemployment-numbers-understate-labour-underutilization/article15808961/

Here are the latest figures from Stats Canada:

http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=2820085&paSer=&pattern=&stByVal=1&p1=1&p2=-1&tabMode=dataTable&csid=

So really, the unemployment is probably much higher than even what the R8 and certainly higher than what the official American BLS figures would suggest.

StewartM

Looking at your graph, and at the fact that unemployment spiked in the inflationary 70s, while it remained relatively low in the low-unemployment 50s-60s, I’d say that wage-push inflation is more a tenant of (capitalist) faith than the conclusion of any empiricist approach. Moreover, the current NAIRU is invalidated by the fact that there are many places in the world with considerably lower unemployment and still no more inflation than we supposedly have.

I’m more of the opinion that anthropologist Marvin Harris was onto something…for if each extra worker hired creates a corresponding gain in output, there is no inflation. However, when an increasing number of workers go into jobs that produce no economic value, then inflation takes off. This includes the military, the police, the prison industry, the mass surveillance state, and *especially* the financial sector. The financial sector that drove the 1948-1973 boom was a mere 4 % of GDP, now it’s 10 % and makes something like 50 % of the profits. And, as any elementary economics student is taught, the financial sector has the ability to create money from nothing. This is why we still have inflation (higher than what is officially reported, most here believe, because of substitution indexes and hedonics) despite having a crappy economy for workers.

The solution to inflation, then, is not to crush wages, but to shrink drastically all the above-mentioned sectors, and to return the making of real goods and delivery of real services back to the US. But that solution makes many a hedge fund manager sad…

Xanadu

Since you mention Stirling, how is he doing? I used to interact with him back on DailyKos and greatly respected his insight. I saw on your blog long ago that he had suffered a severe stroke. His own blog seems to be inactive.