What is geopolitical risk, you ask, and the Saudis answer:

Saudi Arabia warned it could sell off some European debt holdings in retaliation to a move by the G-7 to seize almost $300bn in frozen Russian assets, according to a report by Bloomberg.

The veiled threat was passed along from Saudi Arabia’s finance ministry earlier this year to some G-7 counterparts, as the group weighed seizing Russian assets designed to support Ukraine.

Saudi Arabia specifically signalled out the euro debt issued by France, according to Bloomberg.

Riyadh has been concerned about western efforts to seize the Kremlin’s assets for months. In April, Politico reported that Saudi Arabia, along with China and Indonesia, was privately lobbying the EU against confiscation.

Notice that Indonesia is also involved. China is less surprising, they know that freezing and even confiscation is in the cards for them when things heat up between the West and china.

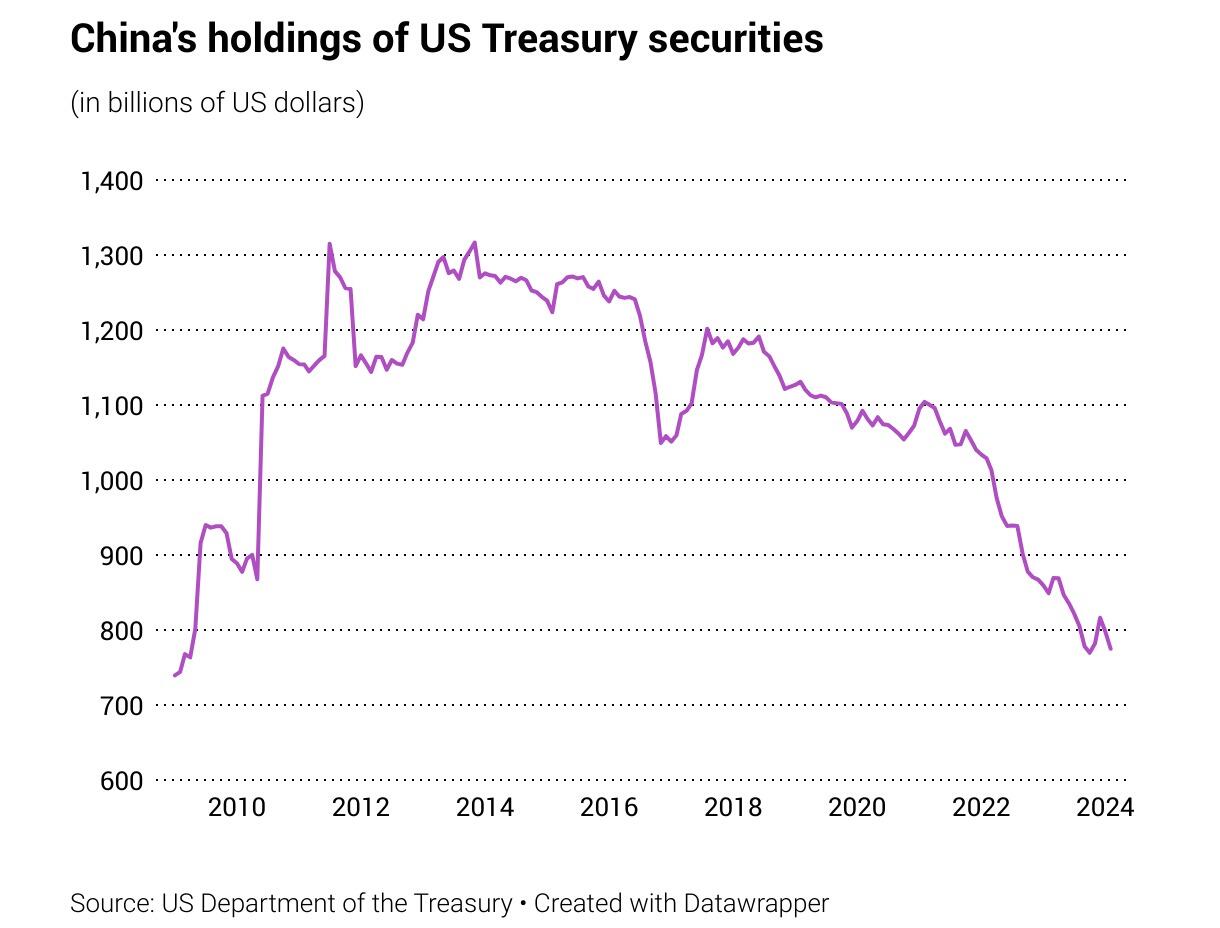

China has been reducing its risk:

Edit: (Or perhaps they aren’t?)

No one wants to do business with nations that will simply take away their money. Freezing was bad, but normal. Seizure is not. Since no one seized or freezed America’s overseas assets when it invaded, say, Iraq, and no one ever seizes or freezes West European assets, it might be thought that this isn’t about “law” but about “power.” For that matter, why haven’t Israel’s overseas assets been seized?

The level of geopolitical risk from doing business in the dollar or using the Western banking system is just too high. Freezing, seizure and sanctions, plus the US applying its law extra-territorially simply because a transfer happened to go thru an American bank even though the sender and end party were both outside of America.

This abuse is long-standing, you can read accounts from the fifties, but it really picked up in the 90s. Indeed there’s an entire book, Treasury’s War, about the phenomenon.

And this is what all the economists and similar pundits who go on about how the dollar can’t be replaced don’t understand: that they are right that the costs of replacing the dollar are significant; that it’s hard, and that it’s not really worth it.

Except it is worth it, because if the cost of trade and money transfers goes up slightly under a non-dollar regime, and even a slight increase is massive when multiplied by the number and amount of transactions, it’s still worth it because of the massive reduction in geopolitical risk. And nattering on about how the Yuan can’t be used because the Chinese can’t accept the costs of using the Yuan is stupid: that’s not what the BRICS are trying to do: the idea is to create a central, multinational currency, and to simply use local currencies whenever possible, while avoiding the Western banking system entirely.

Everyone knows that the dollar and the Western banking system are guns, and that everyone who uses the dollar and the Western banking system are under those guns and can be hit at any moment if D.C. or Brussels desires it.

When this was hardly ever done, it was a risk worth taking. When China was the main industrial power who you could buy almost everything you wanted from, and the West was the only option for most technological goods, well, you had no choice.

But now nations see a way out from under the guns, and they’re going to take it, even if it costs them, because the potential cost of not doing so is catastrophic.

Soredemos

China is ‘reducing its risk’ by dumping Treasury Securities…to then buy Agency Securities with higher interest rates.

The supposed divestment isn’t a thing.

Ian Welsh

Huh. Thanks Soredemos. I missed that and I appreciate you letting me know. Added a link to that argument.

Poul

Another point is that China can hide ownership.

https://www.cfr.org/blog/china-isnt-shifting-away-dollar-or-dollar-bonds

quote

“That table, however, suffers from three other limitations:

One, Treasuries held by non-U.S. custodians wouldn’t register as “China” in the U.S. data. The two biggest custodians are Euroclear, which is based in Belgium (Russia kept its euro reserves there), and Clearstream, which is based in Luxembourg.

And two, the table for Treasuries (obviously) doesn’t include China’s holdings of other U.S. assets – and China actually has a large portfolio of Agency bonds and U.S. equities (they appear in another more difficult to use data table).

The U.S. data would also miss Treasuries and other U.S. assets that have been handed over to third parties to manage – and it is well known that SAFE has accounts at the large global bond funds, several hedge funds (including Bridgewater) and in several private equity funds.”

The best test on China disinvesting in the US is to see who buys the access and which countries China invest it’s reserves in instead. There will be a flow of money to follow.

Revelo

There is nothing special about treasuries or other USA government bonds or cash. USA corporate bonds, USA stocks, USA real estate (land and buildings), USA direct investment (factories and other business assets built in USA) are equivalent ways to accumulate surpluses in USA dollar terms. Some of these assets are as liquid as government bobds and cash: I can sell corporate bonds and stocks and have cash ( fed funds) in my checking account in 2 days. Real estate can almost always be sold easily if you lower the price. Only direct investment is truly illiquid.

Problem of divesting from dollars is who do you sell to and what do you get in return? Same problem with divesting from euros. Selling dollar assets to get euro assets, or vice versa, isn’t really divesting from USA/NATO regime.

Correct way to avoid exposure is simply stop running trade surpluses. USA has plenty of things to sell. If nothing else, just buy up all the copper USA produces and encourage USA to open more copper mines. Trade surplus countries could also start eating more USA almonds, buy USA timber, USA beef, etc, etc.

Dollar collapse occurs when all current trade surplus countries starts thinking like above paragraph: “Sure, we will sell our manufactured goods for dollars, but we want to immediately spend those dollars because we don’t trust you to honor dollar debts long term. So send us some copper, almonds, timber, beef in exchange for our manufactured goods.” Result is price of these commodities skyrockets for USA consumers.

This is Argentina situation. Argentina has plenty of natural resources and agricultural products, so people are eager to trade with Argentina, but they want immediate quid pro quo: our manufactured goods for Argentina’s goods on immediate settlement basis. No one wants to run trade surplus with Argentina because no one wants to accumulate Argentina peso assets, since everyone assumes these assets will be confiscated or hyperinflated away in the near future. USA is heading towards Argentina situation, but it will take another 20 years, IMO.

Purple Library Guy

I instinctively agree with this argument, but I do wonder. The record so far of how people are reacting to climate change issues is, they keep on living in the flood or fire prone places that have turned into death traps, and do their best to ignore the risk. I wonder if nations and the dollar may to a fair degree work the same way.

Jorge

When you own thousands of dollars in bonds, you own an investment.

When you own millions in bonds, you own a financial tool.

When you own billions in bonds, you own a financial weapon. China has moved its financial weapons around on the financial battlefield, and presumably deploys them in battle from time to time.