To understand how tariffs are going to hit various economies, you need to understand how neoliberal era trade and production was set up. In the old world supply chains were much less integrated. In general, if you made it in your country, your supply chain was in your country. There were always some exceptions, especially for resources like nickel, copper, uranium, etc., but these were the exception to the rule. Trade deals and laws in the old era usually required foreign companies which were set up for production in a host country to source a minimum amount of parts from said host country. Almost always this was over 50 percent. If the infrastructure didn’t exist, the company, usually with government help, would set it up.

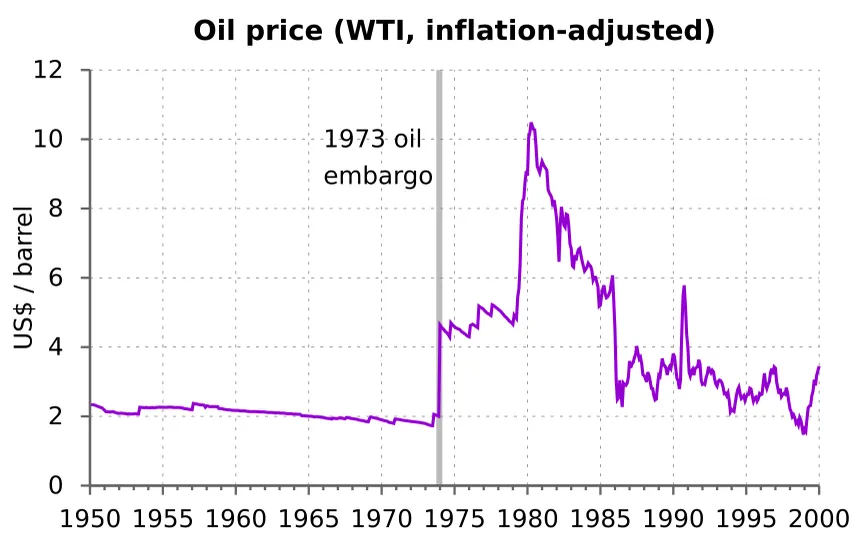

Understand clearly that the neoliberal era came out of the inflation crises of the 70s. It had two goals: 1) To reduce consumer inflation and thus growth in petrochemical use, and; 2) To make the rich much richer.

In the post-war era, most production in most Western countries was meant for the internal market. If you needed it, you made it, with some exceptions: The smaller you were, the more you needed to import some goods, and of course, if you’re Norway or Canada you import bananas and coffee, and you imported any resources you couldn’t produce enough of yourself, like wood, oil, gas, and minerals. The high imports of oil were the old world’s achilles heel, and the inability to import substitutes away from them killed it.

So, most things ordinary people bought have an oil input cost, and the more money ordinary people had, the more they’d do things which had an oil cost. There was almost nothing the Arabs needed to buy from the West at the time: They had small populations, and didn’t have consumer economies. We could sell them military goods, but other than that their needs were modest. They had us over an oil barrel.

I remember the post-war world well, it died in stages. In the 70s and 80s, my family lived in Malaysia, Indonesia, Singapore, and Bangladesh at various times. In all these countries, even Singapore, everything was cheaper than in Canada or America. Ex-pats who had incomes denominated in first world currencies lived very well. When in Canada, we were lower middle class. Overseas we had servants.

Yet despite having cheap goods and services, all those countries except Singapore were third world. Poor.

The post-war developed country play was to keep both prices and wages high, and to make sure wages went up faster than prices, while controlling asset prices, which included home prices and rent. Wages were high because prices were high, and because most production was done in country, or in another high wage country, and because there were tariffs on goods from low cost domiciles, and as they didn’t have much industry anyway, it didn’t matter. Even as late as 1980 or so, America made 97 percent of everything it needed, and the Japanese export surge which changed that still came from a first world, high wage/high cost nation.

In this world, there was certainly trade, but countries still strove to make and grow as much of what they needed as they could at home.

Then came the inflation crises, when due to the oil shocks, wages grew slower than prices — a lot slower. I remember the price of a chocolate bar going from 25c to a dollar in the period of two years (I was a kid, so that’s the sort of price that was important to me. Paperback prices also went from about 99c to $2.50 and then up to $3.50).

So, if you’re going to tackle this, you need to reduce the use of oil, which means reduce ordinary people’s use of oil, which means restraining their income growth. This is why, during the 80s and 90s, every time wages grew faster than inflation, the Fed would slam on the brakes and cause a recession.

But the other play, which also helps keep domestic wages down, is to manufacture and grow and produce in really low wage domiciles. You can slowly crush European, American, and Canadian wages, but people in China, Bangladesh, Mexico, India, and so on are already earning one-tenth of what you have to pay first world workers. They were a lot less efficient workers, too, but even so, if you offshored production, you could reduce the price of goods.

So offshoring became a way to reduce inflation. It also juiced profits, since much of the price decreases weren’t passed on to first world consumers, but hey, win/win if you’re a first-world capitalist or financier. Because production was being increasingly farmed out to developing nations, first world economies financialized and the financial elites took control from the old manufacturing elites (who were, for all their flaws, actually capitalists. Financiers are the lowest form of capitalist life.)

This, of course, lead to first-world countries de-industrializing, and eventually to the rise of China, and the loss of the West’s tech lead, along with the evisceration of the middle class, a huge homelessness crisis, and in Europe, sclerosis.

Now here’s the irony: China has very low costs, so low that I’d argue that the idea that they’re still middle income is false. Their ostensible salaries look low to us, but cars in China can be had for 10K. Earbud equivalents can be had for less than $10. Smart phones are cheaper. Almost everything is cheaper. It’s a weird inverse of the old first world situation: Wages are lower, but costs are lower vs. wages are higher, and so are costs.

Either equilibrium, of course, works for prosperity. What the first-world now has is high-ish wages and higher costs. I saw a factoid the other day that claimed that rent has increased 350 percent more than median wages in the US since 1985, for example.

Now, let’s take closer look at the structure of trade in the neoliberal era: It was based around trade agreements like NAFTA and the WTO which made it essentially illegal to run old-style economies where most production for internal markets was domestic. You couldn’t tariff, you couldn’t subsidize, and you couldn’t enforce ownership rules, domestic content rules, or even rules requiring primary processing of raw resources before export (for example, Canada didn’t used to ship raw logs and canned salmon before selling it overseas.) If you did, the independent trade courts would hit you with huge multi-billion dollar fines. You also had to enforce American IP laws, and thus pay a portion of most profits to America.

What this lead to is countries becoming cogs in production networks; they had part of the supply chain for a product without having most of the supply chain. Their economies were dependent on trade because even if they assembled the final product, most of the supply chain was outside their country.

Let’s take an example from Canada’s current dilemma with regard to American tariffs. Canada’s government made some big bets on EVs, especially batteries. It seemed to make sense: We produce the minerals which go into batteries, so why not manufacture them here and ship them to the US?

This was a BIG bet in Canadian terms. Ontario and the Feds put up about 16 billion of subsidies, perks, and land to get VW to build a battery plant in St. Thomas. This plant, if it goes into full production will produce a million batteries a year. Stellantis’s battery plant in Windsor had 15 billion dollars in subsidies. Honda is retooling to make EVs in Canada, and to produce batteries, and other parts, for EVs — with a 2.5 billion tax cut deal and 2.5 billion in direct and indirect subsidies.

Now here’s the issue, which you may have spotted: They’ll make way more batteries than Canada could possibly need for domestic EVs. Way, way more. With tariffs and uncertainty (after all Trump, could increase them again) none of these projects are viable. Perhaps we could re-tool one of them and really push Canadians to switch en-mass to EVs. If the Feds are smart, that’s probably what they’ll do. (Spoiler, the Feds are not always smart.)

But no matter what, Canada’s taking a huge hit.

In the old world, where you produced primarily for yourself, and if it was more expensive than foreign alternatives said “eat tariffs”, and maybe subsidized, a foreign government couldn’t just decide one day to destroy your industry. Trade was usually in products the other nation didn’t make or grow itself, or genuinely couldn’t make or grow enough of.

The neoliberal trade structure was designed to make national autonomy, in anything (food, energy, manufactured goods) extremely difficult to obtain. It was a giant hostage situation.

It broke down because of stupidity and greed. The full story is long, but the essence is simple: Americans gave China the full stack. The entire supply line for a lot of goods is domestic for China with smaller chunks in close by allies like Vietnam. They were low cost, they had real competitive markets which kept prices low, and, because the manufacturing floor was in China, they eventually took the tech lead. This required about 20 years.

So China’s now the only nation in the world that has an old style “post-war” economy: It now produces primarily for the domestic market, but it also gets the neoliberal era advantage of selling huge amounts of goods overseas. Win/Win. For them.

What Trump’s team (not so much Trump as certain advisors) is trying to do is to re-shore a full manufacturing stack to America. They noticed that everyone industrializes behind some form of price supports, and that usually those are tariffs (China used currency controls), so they’re instituting tariffs. Given that the market for a lot of goods is in the US, they figure, correctly, that a lot of manufacturing will be forced to move back to America.

All those batteries Canada is making.

This screws every single American ally who allowed their economies to be restructured by American lead trade deals in the 80s and 90s. Every single one.

That’s why Canada and Mexico are in for a world of hurt, and also the EU. It’s also why China is not in for a world of hurt — they’ve got the full stack, and a massive domestic market. Plus, because their goods are cheap, they’ve got almost the entire global South plus most of the SE Asian economies as customers.

And here’s the problem for America: All its got is the US market, because it’s fucking every major trade partner it has. The allies (ex allies?) have to go back to an old style economy too, or form a much smaller and stupider neoliberal bloc, and if they can’t sell to America, they aren’t going to buy from America either. So America can get some full stack back, but only what it’s economy can afford.

And the American economy is much smaller than it looks. Much, much smaller. GDP numbers are massively over-inflated by asset price bubbles, much of the income from foreign assets is going to dry up, almost certainly eventually including IP. If you can’t sell to the Americans, why enforce their IP laws and pay them? Foreign ownership rules will start popping back up, and US assets overseas will be sold to locals — often at cents on the dollar. Of course, the same will happen to foreign assets in the US, but the “world” the US inhabits economically will shrink.

And then, if you can’t sell to the US, why the fuck are you using the US dollar for trade? Trump has made huge threats of tariffs against anyone who moves off the dollar for trade, but if you already effectively can’t sell to the US, again, who gives a fuck? Tariff away, asshole.

And when dollar’s hegemony disappears, the US economy will deflate to its actual size — at least a third, and probably half as large as the official numbers. Think someone pricking a water balloon. It’s going to be amazing to watch.

And that, children, is the end of the American era and Empire. It is very close now, and Trump is making it happen much faster. All praise Trump.

(There’s a lot more to unpack about the effects of Trump’s trade wars but this article is already over 2,000 words. For example, will Trump successfully reindustrialize America and make America, if not great again, at least a decent place to live? More on that soonish.)

mago

Stop eating bananas, avocados, tinned food, and drinking coffee.

Consume close to home.

Yeah, that’s simplistic and unobtainable for most, but it would go a long way toward fucking the system and would lead to healthier bodies and minds.

Meanwhile, the machine churns on until it doesn’t.

To quote Jim Morrison, the future’s uncertain and the end is always near.

different clue

Trump may well be ending America itself. The several decades of Presidents and Congresses before Trump helped make America weak enough that Trump would be able to end it with very little real effort.

Perhaps Turtle Island will rise back up out of the Sewage Sea.

GrimJim

Excellent article!

“Will Trump successfully reindustrialize America and make America, if not great again, at least a decent place to live?”

No.

Sorry to steal your thunder.

Sure, there’s more to it than that, but not much.

To re-industrialize, we’d need to have the proper mix of resources, just to start.

We no longer have that.

All our iron is the wrong kind of iron; all our coal is the wrong kind of coal; all our oil is the wrong kind of oil; and so forth. We hardly have any lumber left to speak of. Our farmland has been monocultured to dust, and we will literally starve if we cannot import enough fertilizer.

That’s just the resources issue.

Another issue is that to re-industrialize, you have to have both enough capital (money) and also enough pre-existing capital (plant) to build the new plant (which requires new, trained workers).

Our Financial system is no longer able to spend capital (money) to build capital (plant or trained workers). We have a rentier economy, which is designed to provide massive profits for minimal expenditure… and that expenditure is usually a mix of someone else’s money and simply gutting the existing capital (plant and workers) to extract value.

And then, even if we somehow did have the capital (money) to build capital (plant), we do not have the pre-existing plant to build more plant… or the resources! That all got moved to… China!

And the Chinese will be damned if they allow the US to reverse all that. They also are not going to use their resources and their plant to build new plant for the US.

Europe suffers the same problem.

Then as for building a technically educated workforce to work the plant (let alone the engineers to design and operate the plant), well, you’ve talked about that at length. That requires a belief in science and a good, broad education system geared toward science. Which the US no longer has, and which is being gutted as we speak.

So, we do not have the money, the plant, or the educated workers, nor does anyone in power have remotely the will or desire to change that situation, even if they could.

But they can’t.

We’re just too far along.

We’re going through the Crisis of the Second Century, but instead of an Aurelian we have Caligula.

We are not even going to get anywhere near any sort of re-industrialization before everything just collapses.

Ian Welsh

Jim! Stealing my thunder! 😉

TM

Jim, you’ve hit the nail on the head. Even before you get to the science and engineering training you need to reorganise the incentive structures in society to reward serious, sober competence and systems thinking. Right now, your reward for that is being yoked to the plough of some bullshit ‘job creator’ or other, deepening the furrow of whichever monopoly employs you.

Jan Wiklund

It wasn’t just the oil, even if it helped. It was also the over-production crisis that began about 1965, says Alfred Chandler. The big industrial corporations were so fucking efficient that they could produce much more than there were consumers to buy.

So they couldn’t sell, and needed money. They had to turn to the money markets, i.e. the rentiers. And the rentiers wanted rents.

The effect of this, according to Chandler, was that the rentiers – people who were uninterested in production chains and all that – seized power and reorganized the economy to their liking. CEOs who still wanted to produce were thrown out. CEOs who wanted to outsource, shrink and slim were employed instead.

And that’s the world we have lived in since about 1975-80.

Emma

I think Crisis of the Third Century is the closer analogy. We already had the break down of the illusion of Pax Americana with 3 decades of failed PNAC wars, the breakdown of governance and infrastructure, and the immiseration of the bulk of the population in the Metropole. Gaza ripped out the last vestiges of legitimacy from this order.

Now we have transient and ridiculous idol figures like Trump and Elon passing through, stripping out what’s left because it makes some kind of sense in their mind. Plagues and ecological collapse are again nipping at our heels, and Trump 2.0 wants to rip up public health monitoring and weather/climate forecasting so he can deny that they’re happening.

Mark Level

Yeah, listening to Trump’s speech to Congress last night & it’s pretty much a phantasmagoria of chest-thumping, “America, Fuck Yeah!” bullshit. (I won’t mention what podcast I’m listening to this on, because it makes both anti-Semites & Uber-Zionists erupt angrily on here.)

Ultra-Nationalist bullshit, claims that letting Elon loot Medicare & Social Security will make everyone wealthier, happier and safer. More tax cuts for the richest (which I predict the Dems will roll over on), at least the Donor Class is well served.

I’m halfway thru & nothing about fewer wars, claims he will reshore industry which are clear and obvious lies. (GrimJim called it.)

Lots of legit bitterness toward the failed Bidet admin, but evidently the price of eggs currently is challenging the Bidinflation for supremacy. Bullshit fantasies about “the Gulf of America”, etc.

I usually ignore the stuff in my “feed” but this was posted today, a standoff between a Bald Eagle (Murica) and a Canada Goose, & the Goose avoided becoming a meal. Share is here– https://www.cbc.ca/news/canada/hamilton/canada-goose-bald-eagle-burlington-bay-brawl-1.7473477

Feral Finster

“China has very low costs, so low that I’d argue that the idea that they’re still middle income is false. Their ostensible salaries look low to us, but cars in China can be had for 10K. Earbud equivalents can be had for less than $10. Smart phones are cheaper. Almost everything is cheaper. ”

Ever been on Temu?

Anyway, reindustrialization cannot and will not happen in America, unless and until it pays better to make than to grift.

GrimJim

“I think Crisis of the Third Century is the closer analogy.”

Dangit, that’s what I meant. Stupid brain farts.

miss jennings

Temu is PDD Holdings Inc, formerly Pinduoduom, which is based in Boston. It is an international public company that operates out of China because of China’s massively abundant cheap supply of ‘labor’ – human beings.

Temu has no website. It is only an ‘app.’

Failed Scholar

Excellent article Ian. I was wondering what the goal was behind these tariffs, you can never really be sure what Trump’s goals are because he is so erratic and contradictory from one day to the next. I think your re-shoring hypothesis is a pretty good guess. Rattling the neoliberal cage US corpos are in to ‘encourage’ them to re-shore industry back to the States would be on-brand at least.

Your article didn’t mention it, but one of the major tools the neocon shitlibs use to kill working class wages is immigration, legal or otherwise. I know a lot of lefties are touchy on the subject, but it is one of the favourite weapons the Asset Holders have, because they can not only put pressure on wages and working conditions but also goose housing and asset prices at the same time. Win-win (for them)! It is why labour organisers like Caesar Chávez were so hostile to huge numbers of immigrants, as they (correctly) saw them as a kind of scab labour. Canada has been the ‘shining example’ under the Trudeau II regime, with exploding numbers in every category they could think of to goose the numbers up (foreign “students”, temporary foreign workers, regular immigration pathway, etc). Similar story in most Western countries as well. Interestingly, not a policy China pursues either (in sharp contrast to the “unlimited H1B” desires of America’s tech bros!), although I suppose we’ll see how much that changes in the coming years.

On your point about China and competitive markets, I read recently that China has over 400 different automobile brands alone(!), and a quick glance over the wikipedia entry has an absolute crapload of auto manufacturers: https://en.wikipedia.org/wiki/List_of_automobile_manufacturers_of_China Just goes to show you the huge difference in economic structure between China and the West/USA. In the West we have allowed our car companies to become consolidated to an incredible degree, and it’s the same story in most other industries which we have allowed to consolidate far too much, making the idea of a ‘competitive market’ farcical in some businesses. Canada is especially bad for this, we have a long history of large monopolies or oligopolies controlling most of our markets (although this has a lot to do with how small our market was historically as well). This consolidation is yet another neocon/shitlib globalist freemarketeer result, as in the ‘old era’ as you call it, most countries had their own manufacturers for their domestic goods so there was a plethora of companies in almost every industry – even small countries like Sweden, for example, would have multiple companies making cars like Volvo, Scania, Saab, etc. Now, everything is part of some super mega hyper omni corporation, controlled by some finance scumbag ‘investment’ (looting) fund.

Finally, a question for you Ian, when you said “The post-war developed country play was to keep both prices and wages high, and to make sure wages went up faster than prices, while controlling asset prices: which included home prices and rent.” , is this explicitly stated anywhere in a policy document or some such? Or is this a distillation of Keynes or whoever else was the most influential economist/political scientist in the 1900s?

different clue

Here is a little subreddit opened by a Kentuckian for Kentuckians about what they think/feel about the anti-Canada tarriffs and their falling-domino effect on Kentucky.

(It is by a Kentucky liberal and will get replies from mostly Kentucky liberals until the MAGAs find it and start flash-mobbing the comments section.

Anyway, here it is.

https://www.reddit.com/r/AskReddit/comments/1j44sjw/people_of_kentucky_how_do_you_feel_about_the/

Alan Sutton

Thanks very much for this Ian.

It seems easy to see examples of collapse everywhere but to put them in context, and historically too, is not easy at all.

Very helpful, interesting and informative overview of all the shit that I have been seeing around me for the last nearly 50 years.

Chuck Teague

Bit off topic, but a favourite blog of mine “Progress Is Fine But It’s Gone On Too Long” has occasional posts with the header “We Used To Make Things In This Country”, showcasing long-gone Canadian industry. It’s worth noting that most had good export activities as well as producing for the home market. There are over 300 related posts, and can be a bit of a chore to find by going through the blog archive. Use the following URL to get a quick sample:

https://progress-is-fine.blogspot.com/search?q=we+used+to+make+things

Of course, if you just like old motorbikes, old cars, old airplanes and old tools…this is also the blog for you. Enjoy.

-CT

Jessica

Reindustrializing the US (and the rest of the West) would require a drastic culture shift that gives respect and status to those who produce actual wealth and despises those who become rich without actually contributing anything (such as 99% of the finance sector). I don’t see any force yet capable of even contemplating such a project.

Oakchair

Trump may well be ending America itself.

—

Be that as it may, the masses in the global south still won’t like him.

—-

Our farmland has been monocultured to dust, and we will literally starve

—-

America was a net agriculture importer in 4 of the last 6 years. America’s net food imports are estimated to go from 30 billion to 50 billion from 2024-2025.

https://www.nakedcapitalism.com/2025/03/mass-terminations-have-cut-usda-off-at-the-knees-ex-employees-say.html

Emma

Kevin on Trump’s big beautiful ban on Chinese built ships. Going to kill off what’s left of American bulk exports.

https://youtu.be/ma4IhkcBhDY?si=P0mnk-JvA5BPJwZj

Z

The only thing that makes any sense to me is that Bibi the Butcher’s Butler wants to force a world-wide financial crisis so that a new financial system can be negotiated while the US still has the Kingda Currency. The time to do that is right now before BRICS gets the kinks worked out on their currency.

The $US is still currently the essential grease in the financial system … and the money printer of last resort … but its power is diminishing by the day … and that trend is accelerating … so now is the time to use the huge, internationally interconnected mass of the US’s financial and economic systems as a wrecking ball.

And as long as some other country’s economy crashes first then the US gets to portray themselves as the rescuer to the whole system because they are the only ones that can print up the dough to cover the blow-ups. They have the magic money wand.

Once a crash in a foreign epicenter happens, then Bibi the Butcher’s Butler can throw his arms up in the air over this “crazy”, unstable, unsustainable system that he actually instigated the crash of … though it was always essentially mathematically certain to crash anyway eventually … that will require the $US to prevent a complete collapse and call for a reformed financial system that will probably have to wipe out a lot debts between countries, with the US, since they are the most indebted nation by far, receiving the most initial benefits from it, at least from the accounting standpoint.

Negotiating bankruptcies is literally this mofo’s specialty, mind you. He’s done it plenty of times in the private world and probably deploying the same reframing techniques he is using to rewrite this situation that he used back when he was negotiating the bankruptcy terms on his casino and real estate investments. When the numbers, the accounting go against you, a good bankruptcy negotiator rewrites the situation by playing up the costs to others if they go under, by throwing around their weight … their leverage, while they still have it … to get good terms. And one of the most critical elements in successfully negotiating one from the debtors’s standpoint is the timing of when they declare it. And one has to grudgingly admit, lots of Trump’s properties went bankrupt but it never seemed to financially effect him all that much, certainly not his lifestyle. So whatever he is, he is shrewd about that, at least in that venue.

What he is doing instead though is bullying other countries into financial instabilities that will lead to their bankruptcies. He’s got magic money wand and the US can never technically go bankrupt because of it … for now … and he’s waving it while he still can.

–

Also, all this stuff about the US potentially leaving NATO … hopefully! … and supposedly pulling the rug out on Ukraine is related to the practically bloodless Syrian changeover in power back in December, when Trump was already elected but hadn’t taken office yet. Russia, the US … and, obviously, the US’s boss Israel … the Turks, Iran, the Syrian Army, Assad, probably other ME state actors, maybe indirectly China, and the plethora of militias involved in Syria had to have negotiated something beforehand for that to work out the way it did … that couldn’t have possibly happened that friction-less on the fly. And mind you that it happened right after Hezbollah surrendered.

Note that Russia still maintains their naval base in Syria. I’m guessing that they’ll eventually leave it … Russia might even be holding on to it until Trump does what he promised back in December … and Russia will then probably put a naval base in Iran. That would give Iran security and that could be part of the reason why they pulled the rug out from Hezbollah and didn’t put up any resistance to the Syrian changeover in power.

Z

different clue

This is a welcome development. This is how you delete Musk and delete Musk’s money.

Step by step by step.

And notice that this is not against “America” generally. This is against Musk personally. This is carrying the battle to the heart of the head of the snake.

Link here.

https://www.reddit.com/r/worldnews/comments/1j4hr41/not_going_back_ford_will_cancel_starlinkontario/

different clue

I began reading the comment thread of the link I just offered in the comment I just submitted. I notice an ad within it for coinbase, the crypto trading platform.

As painful as it is for many people to contemplate, those crypto businesses which are Musk-adjacent might also bear a good boycotting so as to begin to tear down and destroy the broader web within which Musk is Shelob the Spider.

Soredemos

@Mark Level

‘Anti-semitism’ isn’t meaningfully a real thing, certainly not around here, but just for the record, Judea Delenda Est

different clue

Here’s an article bearing out Ian Welsh’s prediction that foreign countries will start to invite American scientists to come over and do science.

https://www.404media.co/french-university-to-fund-american-scientists-who-fear-trump-censorship/

different clue

Assistant Vice President Trump has floated the excuse of “fentany” to rationalize the anti-Canada tarriffs. But Trump does not care about “fentanyl” and never did. Here is a little “murdered by words” subreddit entry showing that in more detail.

https://www.reddit.com/r/MurderedByWords/comments/1j4zlru/something_is_very_wrong_herebut/

different clue

Here is ” An open letter to the ‘ I didn’t vote for Trump’ Americans, from the CanadaTravel subreddit. It is politely worded and is as nice as circumstances could possibly permit and it offers some actual actionable advice, as well as a jumping off point for more of the same.

https://www.reddit.com/r/canadatravel/comments/1j4z1vt/an_open_letter_to_the_i_didnt_vote_for_trump/

different clue

This is not tariff-related but is rather another way Trump is reconfiguring alliances. The intelligence agencies of ” the other Four Eyes” are supposedly becoming unwilling to share intelligence with America for fear of Trump’s growing alliance with Russia.

https://metro.co.uk/2025/03/06/five-eyes-alliance-starts-crumble-four-nations-give-us-cold-shoulder-22679726/

Perhaps the Other Four Eyes might start calling themselves the Four Eyes Minus One . . . or they might just start referring to the US as Big Cyclops.

miss jennings

supposedly becoming unwilling to share intelligence with America for fear of Trump’s growing alliance with Russia

From the same UK-based ‘metro’ outlet:

Donald Trump threatens Putin with new sanctions after latest missile onslaught

https://metro.co.uk/2025/03/07/trump-threatens-new-russia-sanctions-over-ukraine-attacks-22689050/

The WSJ today:

lead article:

Trump Threatens to Hit Russia With Sanctions in Push for Peace Deal President’s remarks follow Russia’s latest missile and drone attacks on Ukraine

next article a bit further down ‘page one’ of the website:

Trump Is Overturning the World Order That America Built As the president embraces Putin, longtime allies are starting to view the U.S. not just as unreliable but as a possible threat to their own security.

———

Returning to the first two paragraphs of the metro article different clue linked to:

“Donald Trump’s rehabilitation of US-Russia relations has forced allies to consider scaling back intelligence, it has been claimed

claimed by who?

Members of the ‘Five Eyes’ alliance and nations including Saudi Arabia and Israel are becoming increasingly wary about what to share with the White House.”

Donald Trump’s ‘daughter-in-law’ Ivanka and her father’s psychotically Judeofacist policies were described thusly by The Israel Times:

‘These strongly pro-Jewish and pro-Israel policies implemented by President Trump were influenced by his daughter, Ivanka Trump and her husband Jared Kushner, who is an Orthodox Jew. In a real sense, Ivanka Trump is the new “Queen Esther”.

Ivanka Trump, who sometimes worships in a Chabad Lubavitch synagogue, walks the corridors of power at the highest levels while proudly promoting Jewish values. In observance of her Jewish identity, First Daughter Ivanka has a kosher “Mezzuzah” on the door of her office in the White House and her children attend Jewish day school.’

https://blogs.timesofisrael.com/ivanka-trump-is-the-new-queen-esther

Jared and ‘Ivana’ have mucho holdings in a Saudi Arabian ‘sovereign wealth fund’ not to mention their affinity for all things Jewish and ‘Israeli.’

————

Trump Administration Cancels $400 Million in Grants and Contracts to Columbia Move targets the Ivy League school over allegations of antisemitism

https://www.wsj.com/us-news/education/columbia-trump-antisemitism-funding-1146c086?mod=hp_lead_pos8

Israel is building a ChatGPT-like tool weaponizing surveillance of Palestinians

‘The Israeli army’s efforts to develop its own LLM were first acknowledged publicly by Chaked Roger Joseph Sayedoff, an intelligence officer who presented himself as the project’s lead, in a little-noticed lecture last year. “We sought to create the largest dataset possible, collecting all the data the State of Israel has ever had in Arabic,” he explained during his presentation at the DefenseML conference in Tel Aviv. He added that the program is being trained on “psychotic amounts” of intelligence information.

According to Sayedoff, when ChatGPT’s LLM was first made available to the public in November 2022, the Israeli army set up a dedicated intelligence team to explore how generative AI could be adapted for military purposes. “We said, ‘Wow, now we’ll replace all intelligence officers with [AI] agents. Every five minutes, they’ll read all Israeli intelligence and predict who the next terrorist will be,’” Sayedoff said.’

https://israelpalestinenews.org/israeli-intelligence-chat-gpt/

———-

You can walk around with a huge STAR OF DAVID dangling from your neck and/or a little black hat on on any of these campuses without any problems whatsoever. The same holds true throughout the United States.

FREE SPEECH

FREE PALESTINE

FREE PALESTINE

FREE SPEECH

We’re not all Palestinians yet.

miss jennings

Donald and Ivanka Trump:

https://youtu.be/rq2QFvWFUC0?t=3900

MAGA already calling on Trump to fire AG Pam Bondi. Here’s why

‘In just the first few weeks of her new role, Bondi promised to release the documents related to the sex trafficking case of Epstein—a popular topic for conspiracy theorists.

She released the small batch of documents last week, but it did not include any bombshell information that had not already been made public before.’

Gee, what a surprise.

https://www.nj.com/politics/2025/03/maga-already-calling-on-trump-to-fire-ag-pam-bondi-heres-why.html

Of course, many of us are crazy ‘conspiracy theorists’ who dare to think beyond the matrix a bit.

The term ‘conspiracy theory’ has taken on a life of its own perhaps well beyond the original intention of Nicholas Katzenbach’s memo to WH Press Secretary Bill Moyers on November 25, 1963 urgently advising Moyers et al of the need to convince the public that “Oswald was the assassin” and that “he did not have confederates.”

————

The ‘open letter’ reddit that different clue linked to is pretty grotesque in its totalitarianess. All/the overwhelming majority of the people there come across as smug petulant snobs who hold no quarter for anyone who didn’t vote for Kamala Harris.

If one voted ‘third party’ or write-in or god forbid didn’t vote at all then said person is in many ways worse than someone who voted for Trump. At minimum, you better have a damn good reason why you didn’t vote for the democratic nominee Kamala Harris.

I am not telling anyone not to vote but just a quick reminder that we never figured out what went down with diebold and George Bush, let alone all the obvious voting machine shenanigans with Bernie which people in his campaign were imploring him to look into – but of course he never did.

We are given no paper receipts/records of ‘our vote.’ We may get a sticker to wear around for the next day or so proudly proclaiming ‘I VOTED!’

https://youtu.be/zI3yU5Z2adI?t=264

https://www.youtube.com/results?search_query=kamala+word+salad+compilation

different clue

Here’s an article called ” Suspicious Tesla Sales Surge Triggers Canadian Government Investigation”

Here is the link.

https://motorillustrated.com/suspicious-tesla-sales-surge-triggers-canadian-government-investigation/149947/

Would Canada have the power to cancel EV-subsidies in the case of Tesla in particular?

If not, would Canada consider it worthwhile to suspend all EV-subsidies for the duration until the Tesla Musk Lamprey problem has been solved?

different clue

Here is a little video segment of Ontario Premier Ford announcing the beginning of 25% tax on electricity from Ontario to three neighboring American states.

I am no expert, but my intuition ( ” muh feelz”) suggests to me that if the political ice floes grind around just right, Premier Ford could become the Prime Minister of Canada within the lifetime of this blog.

Anyway, here is the link.

https://www.reddit.com/r/world24x7hr/comments/1j8781c/ontario_announce_a_25_surcharge_on_electricity/

Clonal Antibody

You might find this X thread interesting

https://x.com/Dr_Keefer/status/1899434328787964268

different clue

It looks like Premier Legault of Quebec is still considering . . . or should I say “mulling over” . . . the possibility of tariffs on electricity from Quebec to America at some future point in time, maybe.

I remember once flying over that part of New York State through which the super high tension lines from Quebec came down into and through New York. Them suckers was huge!

https://www.ctvnews.ca/montreal/article/quebec-considering-surcharge-on-electricity-exports-to-2-us-states-amid-trade-war/

different clue

And here is Mike Myers actuating a meme which I claim I thought of in my mind as long ago as a few days ago . . . Elon Musk as Doctor Evil. And if Mike Myers could find that actor who played mini Me in the movie, perhaps Mike Myers ( as Musk) could bring that little actor on as mini-Me/ mini-Musk . . . with his face made up to look like Donald Trump.

https://www.ctvnews.ca/video/2025/03/09/mike-myers-is-back-as-elon-musk-on-snl/

different clue

Or I just thought of something maybe even funnier, maybe not. If Mike Meyers came on again as Doctor Evil Musk, and brought that little mini-me actor on with him, the little mini-Me could be made up to look like a cross between mini-Me and Musk’s little kid.

And little mini-Musk could repeat real loudly the actual quotes of what Musk’s little kid actually said to Mister Assistant Vice President when he was in the Oval Office. Here is what I trust is the actual video and I hope the kid’s sound is up enough that between lip-reading and hearing it that people can tell what the kid is saying.

https://www.youtube.com/watch?v=VMJEGOvpoWY

Well . . . in the Mike Meyers’s ” Doctor Evil Musk” skit that I envision, little mini-Musk would be saying those quotes REAL LOUD and blowing his nose in his hand and wiping his hand on Trump and stuff like that there.

shagggz

@different clue,

The actor playing mini-me has been dead since 2018.