Dollar privilege: everyone using the dollar for trade, and the US controlling the system that moves currency around the world is important. When it goes away, and it will in the next five years, I’d guess, the US will take a huge hit to its ability to command the world’s resources and will lose most of its ability to sanction anyone outside the US vassaldom area. (And the vassals will find it easier to leave if they choose.)

But to see the loss of dollar privilege as primary is a huge mistake. It’s downstream from the only thing that really matters: actual national capacity.

Industrial output, tech, secure resource availability (people, food, energy, rare earths, oil, uranium, etc.)

Fundamentally everything flows from having the most industry and the tech lead, combined with enough resources to make use of that industry and tech lead. Dollar privilege happened because after WWII the US controlled over 50% of the world’s manufacturing ability and was the most powerful non-Soviet state in the world. As such, in a cold war situation, it took charge and created a “free” world in the image it wanted. That certainly included controlling money and money flows, and if you wanted or needed anything you either had to get it from the US and over time its allies (Europe, Japan, South Korea, Taiwan) or from the USSR. When the USSR went away, the US was able to go hog-wild with sanctions, because there was not alternative to using their system and buying from them and their allies.

Now there is. Almost everything you want you can get from China, Russia or some nation outside the “West”. There are exceptions, but they are small in number and that number is decreasing every year. It won’t be long before China delivers satellites to orbit cheaper than the US and had domestic jets that don’t have to buy jet engines (one of those last things) from the West. And hey, virtually everything the Chinese sell is cheaper than if you buy it from the West.

But this is not just about civilian stuff. The fact is that China’s military tech is now more advanced than America’s in most areas. Better missiles. Better drones. Better jets. On top of that they have far more capacity to build ships and drones and missiles and weapons and ammunition than does the West.

Industry/tech (and the resources to use them)=military power. America had a tiny army before WWII, but was able to ramp up seemingly overnight because it had more industry than anyone else. There is zero possibility of America winning a conventional war against China. Zero. Cannot happen. The last chance of doing it was a “resource choke” but that can’t be done now because Russia isn’t going to cooperate. It required Russia as an ally.

To return to our initial point, dollar privilege is a lagging indicator. You get currency domination after you’ve already won, and you lose it after you’ve lost. Once you are no longer the world’s leading industrial and technological state you will lose it, the only question is when. America could have kept it for quite a long time if America’s leaders hadn’t abused it with constant sanctions because while currency privilege has advantages it’s also damaging to the actual productive economy of whoever has it and China is going to great lengths to avoid this.

But as it stands everyone with sense wants out, so the US will lose dollar privilege soon thru most of the world, without, if China can manage it, China creating Yuan privilege. America may retain it in relation to the usual vassals: the anglosphere, Japan, South Korea, Taiwan and Europe, but once the alternative exists (and the Chinese and Russians have and are building those alternatives) and has reached critical mass, one by one even the vassals will move to using other systems in addition to SWIFT and will make themselves largely sanctions proof.

This is another “last days of the American Empire” thing, and thank God. Dollar privilege has been used, literally, to kill many millions of people thru the world, and to impoverish hundreds of millions. It will be a great day for every non-American when it ends.

This site is only viable due to reader donations. If you value it and can, please subscribe or donate.

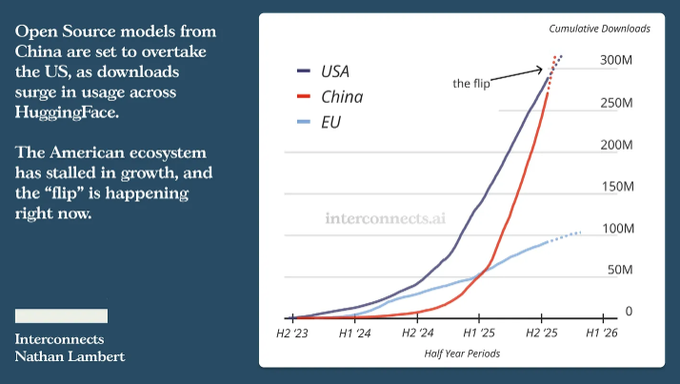

This is, again, because Chinese models are at least 90% cheaper to run, and mostly open source. Only a complete and utter moron would run their business using proprietary models where OpenAI or Anthropic can jack up the price any time they want or depreciate the model you actually needed. Even US startups agree, 70 to 80% of them are using Chinese open models.

This is, again, because Chinese models are at least 90% cheaper to run, and mostly open source. Only a complete and utter moron would run their business using proprietary models where OpenAI or Anthropic can jack up the price any time they want or depreciate the model you actually needed. Even US startups agree, 70 to 80% of them are using Chinese open models.