I didn’t see this coming:

In a move that stunned traders, analysts and policymakers alike, China has just announced a complete halt on all liquefied natural gas imports from the United States. A decision made abruptly with no prior indication, no phased reduction and no explanation beyond a terse statement from Beijing…

…China was one of the fastest growing markets for American LNG, importing more than four million tons annually. Cutting that overnight is more than symbolic, it’s surgical.

Early reactions have been nothing short of panic. Energy markets were jolted, LNG prices in Europe and Asia swung wildly and US energy firms reported immediate financial hits…

…Overnight, the US was eliminated from one of the world’s most lucrative gas markets worth more than US$2.4 billion a year. Let that number sink in. More than 4.4 million tons of American LNG every single year now suddenly has nowhere to go.

Ports along the Gulf Coast are already feeling the shock. Massive LNG tankers are sitting idle with nowhere to dock, no buyers to receive them. Terminal operators are scrambling to reroute shipments, but the damage is done. Revenue streams are drying up. American energy firms are haemorrhaging cash: millions of dollars in losses each day…

…

China has begun rerouting LNG cargoes originally meant for East Asia straight into Europe’s energy-hungry markets. The message is clear: If the US wants to weaponise trade, China will weaponise its energy strategy.

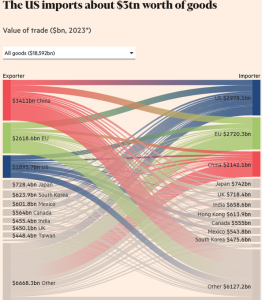

Why Europe? Because it’s vulnerable and China knows it. Since the Russian invasion of Ukraine, the European Union has been scrambling to find a replacement for Russian gas. For the past two years, the US had been the emergency supplier, shipping LNG across the Atlantic to prevent blackouts and political chaos in capitals from Berlin to Warsaw. But that relationship, built out of necessity, was never guaranteed.

And China just exposed that fragility. By stepping in with competitive LG offers at lower prices, China is capitalising on a moment of weakness. European energy firms, already strained by inflation and political pressure, are welcoming any chance to secure stable and affordable supply.

One of the major stories of the Ukraine war is how the US took advantage of the pipeline sabotage and sanctions to sell Europe natural gas. Expensive natural gas. This increased the energy cost of heavy industry and led to a lot of European, especially German factories, shuttering and moving to the US.

Win/Win. For America.

China isn’t itself an LNG exporter, but it controls a lot of the market thru long term contracts. It has an excess of what it needs, and it just signed a new contract with Australia for long term supply:

In March 2025, Australia’s energy giant Woodside Energy inked a game-changing 15-year contract with China Resources Gas, one of Beijing’s top natural gas distributors.

Under the deal, Australia will begin supplying 600,000 tons of LNG per year, starting in 2027. While the volume might not seem earth-shattering on paper, the symbolism behind the agreement is monumental…

… Australian LNG is currently 20% cheaper than US shipments largely due to proximity and lower transportation costs. It takes roughly 10 fewer days for Australian cargo to reach Chinese ports, compared to those from the US.

Australia, of course, has been rather anti-China and a big US ally, BUT cold hard cash, err, trumps that.

What’s becoming clear about this trade war is that China has gamed it out. They thought ahead, having learned lessons during the first Trump administration: they were ready. They’ve massively reduced their vulnerabilities and carefully examined America’s weaknesses, and now they’re hitting them. Hard.

This realigns American allies in Europe and Australia more towards China, it hurts the US, and it highlights the benefits of doing business with China.

Xi Jingping

Xi, as we discussed in our last article, has been planning for this, not just since Trump, but since he took power. He’s locked and loaded and he’s firing his guns. The more Trump doubles down, the more America will be hurt, because China needs America less than America needs China. In many cases America firms have no choice but to buy from China, there is nowhere else to get what they need, while China either has alternatives or has already written off buying from the US, as is the case with chips. To China, America is a lost cause: it can’t be relied on either as a supplier or a buyer.

If America’s effectively a write-off, well, treat it like a write-off. And that’s what China is doing.

Trump and many Americans thought that China was the vulnerable one, that China was in a weaker position than them (they made the same mistake with Canada). It isn’t. Now Europe and Japan are holding weaker hands than the US in a trade war, but here’s China actually strengthening Europe.

It is to laugh. Trump’s fundamentally incompetent, a D- player and he’s going up against Xi, who’s arguably a great statesman, and so far, Xi is ripping him a new one.

This is what actual planning and actual competence looks like: see threats in the future and get ready for them. When someone declares you their enemy, as the US has repeatedly, take them seriously.

We haven’t seen that in any Western country in at least two generations.

You get what you pay for. This blog is free to read, but not to produce. If you enjoy the content, donate or subscribe.

Well, maybe. Who the hell knows what he’ll do. Anyway, tariffs are back to 30% on China and 10% on America.

Well, maybe. Who the hell knows what he’ll do. Anyway, tariffs are back to 30% on China and 10% on America.