I’m basing this on current trends and what I see as the most likely outcome.

Russia will take about 30% to 40% of Ukraine: the East and the coast along the Black Sea, areas that are generally Russian ethnic or speaking. While they were pushed back from Kharkiv, I think they’ll take the Oblast by the end of the war. Basically, see where Russians are the majority and that’s the land that Russia will feel it can keep and not fight an endless guerilla war.

Russia will take about 30% to 40% of Ukraine: the East and the coast along the Black Sea, areas that are generally Russian ethnic or speaking. While they were pushed back from Kharkiv, I think they’ll take the Oblast by the end of the war. Basically, see where Russians are the majority and that’s the land that Russia will feel it can keep and not fight an endless guerilla war.

They make have to take more land than that to force a peace on terms they can stand, but they won’t want to keep it because everyone knows the West is trying to draw them into a long term guerilla war. (Such a war could be won in Ukraine because of the terrain, but doing so would require a lot of killing, deportatons and camps and many years. It’s not worth it for Russia.)

The Russians original goals will not be met, and Finland and Sweden will joint NATO (although they were already quite integrated), so in one sense it can be said that Russia has “lost”. In certain other senses it can be said to win.

But let’s look at the major players, one by one.

Ukraine: the big loser. Unless this war goes far different than I expect (possible and I’ll admit it if it does) they’re going to come out of it a smaller country with no coast, who has lost their industrial heartland and even if the gas is turned back on, they will lose most of the transit fees in a couple years max as the EU transitions away. They will find that the “rebuilding” they were promised is IMF style neoliberalism and the average person will wind up worse off.

Verdict: Disastrous Loss.

The EU: In the win column, the EU should have built up a larger military long ago and will now do so. They will be more unified, at least initially, feeling they have all supported a war and with fear of Russia acting as unifying glue.

In the lost column they have firmly moved into the US satrapy column. In order to move out they would have to create their own army that is not dependent on US built military equipment and that’s the opposite of what they’re doing. (Foolish, because the US is losing its ability to build either ships or combat planes. The F-35 was a boondogle, Boeing has lost its engineering chops, and they recently decided to decommission built ships because they are so bad.)

The increase in price of fuel (US gas is about 50% more expensive than Russian), commodities and food as well as the general inflation shock from the Ukraine war will lead to a poorer Europe. Spending more money on the military will make ordinary people feel worse off and so will inflation. Industry will be badly damaged by increased fuel and mineral prices. All of this will lead to increased political instability and is likely to help the fascist right and possible the more radical left (if the left ever gets its act together.)

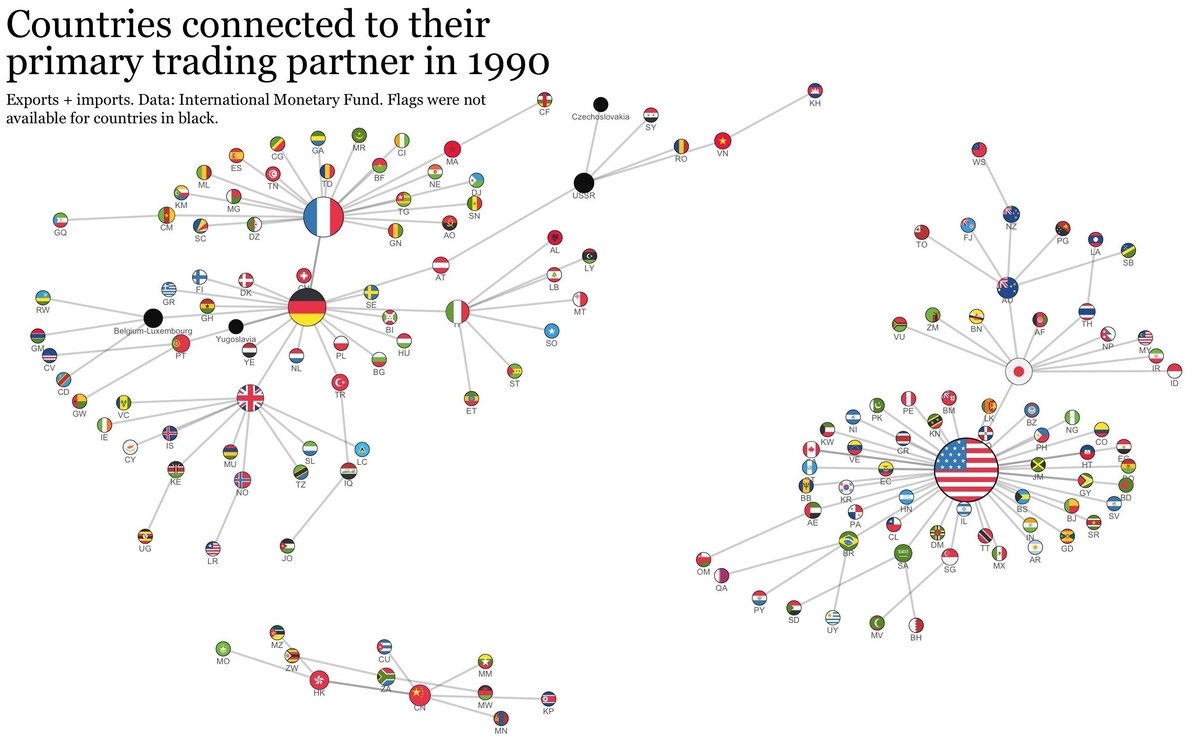

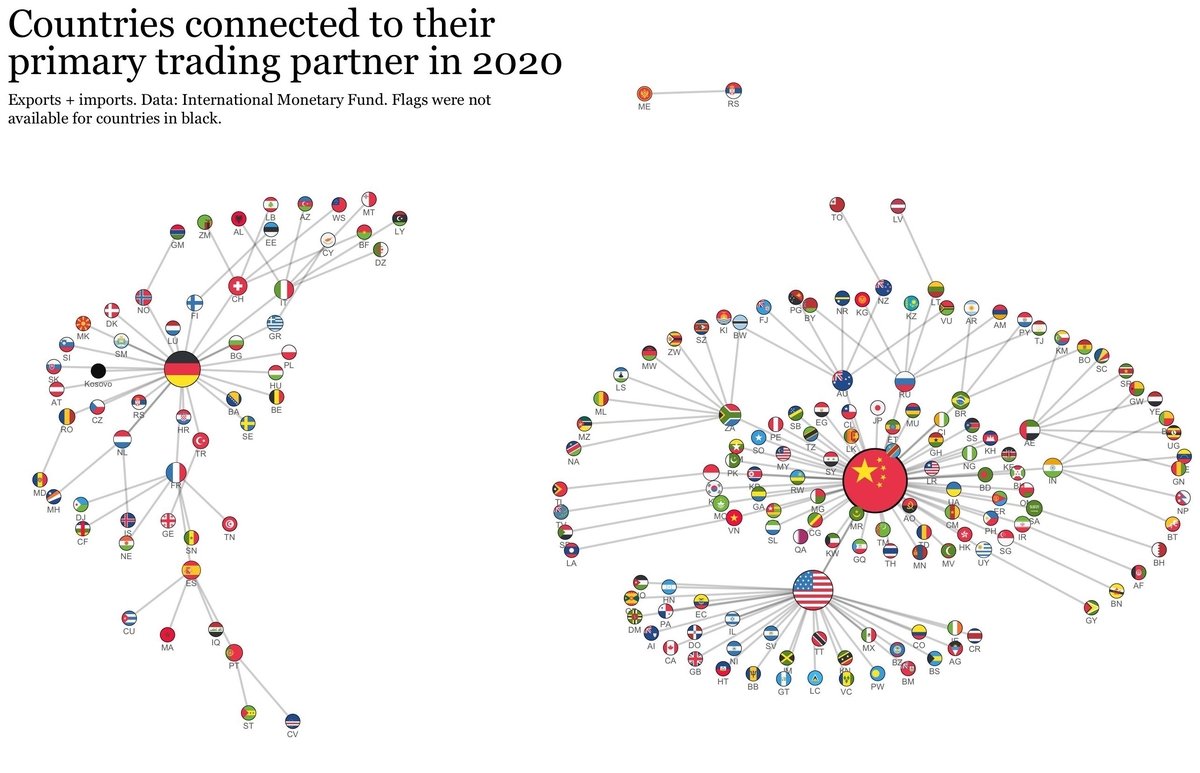

Joining the US in such huge sanctions and seizing Russia’s reserves (“frozen”) means that they are choosing to join the US side of the new cold war world rather than being a third pole, and this will eventually limit their trade options, as they, like the US, cannot be trusted with money.

The EU is, overall, likely to come out of this war poorer, more isolated and with increased political instability, but with a much larger military and feeling more unified at the elite and country to country level (at least until and if political instability changes that.)

Veridict: Slight Loss.

The US: The US has gotten Europe firmly back as a satrapy. NATO expands, the Europeans will spend more more on US military goods and buy expensive US gas and oil. The possibility of Europe becoming independent and forming a third pole in the upcoming cold war between the US and China is now minimal, and essentially zero for at least a decade or two.

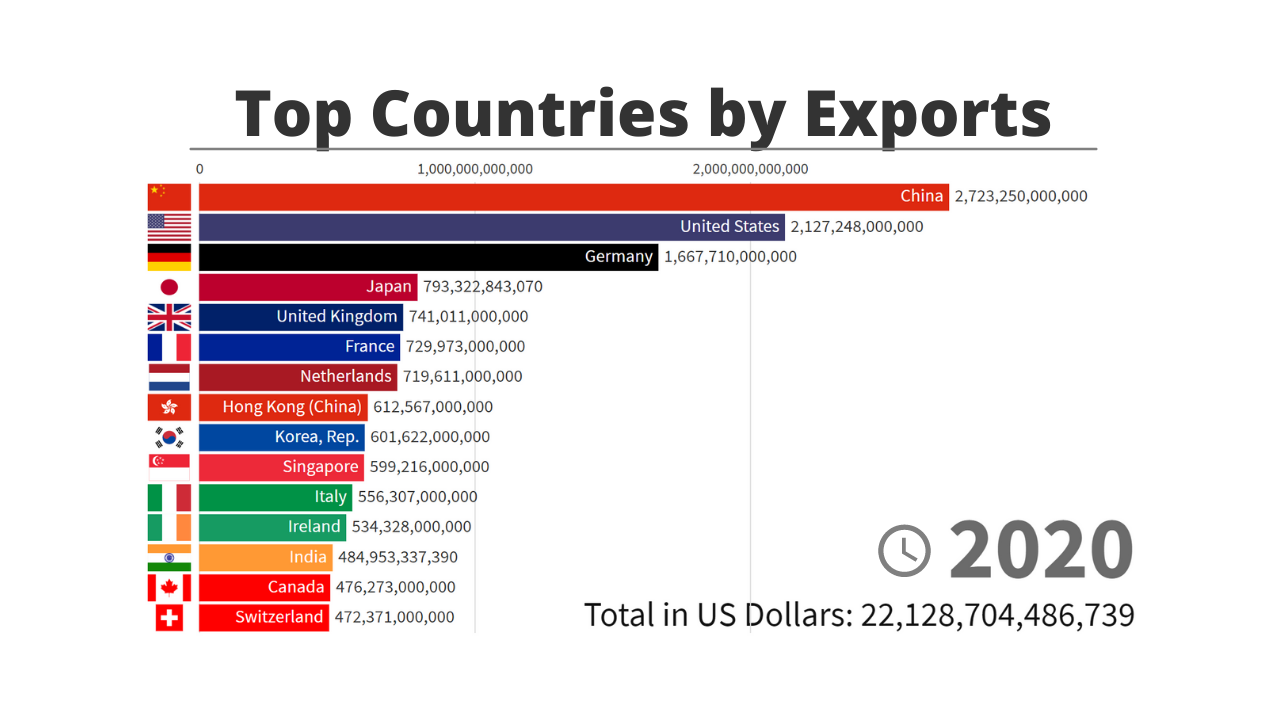

On the negative side, Russia is now firmly in the Chinese sphere. Because the US’s strategy in the case of a war with China would be to strangle China with a military enforced trade embargo, this is a big problem. Russia can supply China with massive amounts of food, fuel and commodities, making the “choke them out” strategy against China unlikely to succeed. Likewise a friendly Russia means China has a relatively secure flank to the Northwest. There are even signs of Chinese-Indian rapprochement, and though I’ll believe it when I see it, India not joining against China would be a huge boon to China.

Since China is the “real” threat, not Russia, the one country that can replace the US as the world’s most powerful nation, strengthening China’s position is a loss.

The US also will suffer due to inflation from knock on effects of the Ukraine war, and that will cause increased domestic instability. Elites continue to funnel massive money to the domestic security apparatus (police of various varieties, spies who target US residents), however, and elites feel fairly secure, though I think they’re wrong as they’re funneling resources to police who stand a good chance of joining a right wing uprising.

The final major effect for the US is that freezing Russian reserves and encouraging the massive level of sanctions, is seen by most of the world as evidence it’s not safe to keep money in the US lead banking system, or even to trade with them. This has accelerated de-dollarization and I suspect will be seen as the precipitating event of losing reserve status for the American dollar. The world will split into two financial blocs, one centered around China-Russia, the other around the US-EU. The US receives huge benefits from reserve status and from being at the center of the world financial system, and as with Britain after WWI, it will suffer mightily when it loses this position.

My evaluation is that what the US will likely gain from the Ukraine war is less than it has or will lose: dollar hegemony and being the financial center of the world are a big deal, and confirming Russia as a junior Chinese ally makes their main geopolitical rival far stronger.

Verdict: Loss

Russia: Russia has weathered the initial economic storm well, but most EU countries will move off Russian gas and oil. Some of that gas and oil cannot be brought to market anywhere else for a few years (probably 3) until new pipelines are built and while there are customers, they will pay less than the Europeans did.

Sanctions will not cripple Russia, but there are goods like advanced semiconductors and, more importantly, some tech needed for gas and oil extraction, that they will be cut off from. China cannot immediately replace those oil and gas related goods, and they are at least ten years behind in semiconductors (and themselves cut off from some key capital equipment they can’t yet build). That said the oil and gas tech is probably within quicker reach, and Russia doesn’t need the most advanced semiconductors in large quantities so far as I know.

In most economic terms Russia will be OK: they have a big food surplus; they have more than enough fuel, of course, and they can buy almost everything they don’t make from China, who is not going to cut them off; indeed, rather the reverse. India is also rushing to cut deals with Russian businesses. Sanctions will force more import substitution and help overcome the “resource curse”, making it cost-effective to make more things in Russia (if they aren’t overwhelmed by cheap Chinese goods.)

Sanctions will not cripple Russia the way they have many other countries, though they will be felt. Nor will they cause a revolution and if there is a coup it will be because Putin is old now and may be ill with Parkinsons or something else.

In territorial terms Russia likely to wind up larger. They get the industrial part of Ukraine and the coast, they can send water to Crimea (which has been cut off from years, and whose agriculture was devastated as a result) and while many will say they didn’t win the war, etc… people who want to stand up to them will not be keen on “winning and losing 30% of our country.” If that’s victory, it looks pretty bad.

A unified Europe with more countries in NATO and a bigger military is a loss for Russia, and one can expect that NATO will move more missiles and ABMS close to the Russian border, including hypersonic missiles as soon as they have them. In that sense the war is a clear loss: Russia wanted those weapons removed from near its border, and there will probably be even more of them.

In the end Russia will be able to credibly claim it won the war as a war: it took territory and kept it and it’s hard to say that a country which took its enemy’s territory lost a war. That said, there will be a case that it is a Pyrrhic victory, in that there is an economic hit, NATO has expanded, Europe will have a bigger military and so on.

The counter-case is simple: Ukraine was talking about getting nukes and had started shelling Donetsk in what looked like a prelude to invasion. Russia didn’t get its maximal goals, but it did gut Ukraine as a threat and did secure Ukrainian land in what is likely to be a semi-permanent fashion absent an all out NATO/Russia war.

The maximal goals didn’t happen, but in a bad situation Russia may reasonably claim it got quite a bit. As for sanctions, every year there had been more of them, none had ever been rescinded and all the war did was move them up.

Verdict: Marginal victory.

China: Yes, strictly speaking China isn’t involved in the war, but the war affects China greatly. China needs about 10 years to get to a reasonable parity with the US in semiconductors and aviation, the golden technologies of US hegemonic rule. The Ukraine war has made it clear they probably have less time than that, and that the world economic order is likely to split sooner because China is stuck between US demands to support sanctions and its own strategic needs, which require Russia as an ally, or at least a reliable supplier. Russia being decisively defeated or economically crushed would be catastrophic for China, so they must keep it alive and viable.

Still, all in all having Russia unable to sell to or buy from the West is unbelievably good for China: there is no alternative for Russia. If they can’t go to the West they must go to China. India may be willing to trade, but India’s economy is tiny compared to China’s and its industry scarce. China can make almost everything Russia needs and everything it can’t make it’s working on learning how to make. And, as previously discussed, Russia as an ally makes it impossible for the US to choke China out in a war.

Verdict: Victory

Concluding Remarks: Of course all of this based on a model of how they war will go which may not be the case. Perhaps the maximalists in the West are right, and the Russian military is fundamentally incompetent, can’t do logistics to a disastrous degree, and is on the verge of collapse. If you think Russia can’t even win the conventional war, all of this is is nonsense because a definite loss is likely to lead to regime change and possibly even collapse.

Likewise if you think that sanctions will have much more effect than I do, or that China will not integrate with Russia economically, then this is all wrong.

But overall, this war looks like a case where Russia gets a marginal victory; the US and the EU get some wins but their victories are effectively Pyrrhic, and China is the big winner.