Models of economics which don’t handle power are marginal at best. They serve only to describe what happens in situations where no one has enough power to set the rules or where there is a central authority which acts to keep any other actor from having enough power to set the rules.

The Standard Model of Power in Markets

Assume that people want two things: They want stuff and they want security. That is to say, they want to know they can keep what they have.

People who become rich usually fall into one of three categories:

1) People who lucked out by being in the right place at the right time (many people who became rich in the internet bubble, for instance, just happened to be working at the right place at the right time);

2)People who are obsessed with something that other people value highly. Like many musicians in the era of mass-produced music before the rise of the internet. Or like J.K. Rowling. These people are also lucky, in the sense that the products of their obsessions are highly marketable at the time of output;

3) People who are obsessed with making money. They think of little else and have devoted their life to it.

In all three cases, once you’re rich, the needs that drove you there don’t go away. Wealth effects people, but it rarely changes either the obsessive need that drove them, nor the human need for security.

The second group is the least dangerous because their primary motivation was never money and their obsession drives them away from thinking too much about money.

The first group, those who got lucky, are the rank and file of the “I’ve got mine, screw you. Jack” brigade. This includes people far beyond those who became truly rich, like those who worked at startups by luck or those who won the genetic jackpot and inherited; it also includes those who won the generational jackpot: the GI Generation, for example, or older Boomers.

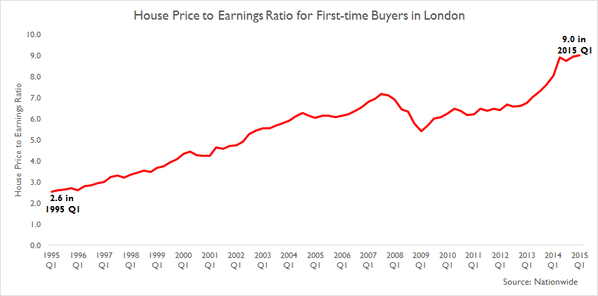

The GIs may have been born during the Great Depression, but they spent their prime working years during the greatest general wage increase of the last few centuries. They bought houses when they were cheap, then they benefited from the massive appreciation of housing values from a multi-generational period in which house prices increased faster than wages, capped by an actual housing bubble for those who lived long enough.

In generational terms, they were born on second (though not third). They had the GI Bill, great jobs, great job security, great pensions, great health care, and so on.

They lucked out. It’s not that they didn’t work hard for what they got, but the same amount of work in a different time or place wouldn’t have reaped the same rewards.

People like this become conservative. The GIs start off as the footsoldiers of post-war liberalism, but they wind up Reagan Democrats. They have theirs and they vote for politicians and policies which make sure that what they have is secure. The net result of those policies has been to pull the ladder up after them–to make their children and grandchildren less prosperous.

If you got lucky, then preservation of capital is the first rule. People who got lucky are against high taxes, because they can’t expect to make more money. They are especially against high taxation of unearned income, because their advantage is unearned income–their houses, stock portfolios, bonds, and so on. Their money makes money.

These are their interests. Most people act on their interests as filtered through their beliefs.

Thus, we come to group #3. The people who made a ton of money and who did so because that was their goal; they were always obsessed with money. This group also includes those people who came into a lot of power because they were obsessed with power, though the dynamic is a bit different.

These people still have the need for security. The best security is the legal protection of no one else being able to join your business. Some businesses have this quality innately. For instance, suppose you are the cable or phone provider to an area. You have the phone lines, you have the cable; it’s unlikely anyone else can drive those lines.

But the government, in the 90s, forced phone providers to lease their phone lines to internet providers (dial up, for ancients). So even having a physical monopoly isn’t security if the government acts against you.

High speed internet, over phone or cable, is not something those companies in the US (or Canada) are forced to allow other companies to sell.

The first concern for someone who is wealthy is getting protection from whoever is politically powerful. Government, if you wish, though it can be warlords or Kings or the local tribe, depending on the culture. They need sanction to keep what they have.

This is especially true of businesses which aren’t natural monopolies: selling weapons to the government, for obvious reasons, or; selling music, which could be copied by anyone (say hello to copyright laws); being a lawyer and not wanting too many other people to act as lawyers (say hello to bar exams and law schools); selling genetically modified food of which people are scared (make GMO labeling illegal). Creating money out of thin air, which is what banks, brokers and so on do, might be considered the ultimate monopoly. They sure don’t want Joe Blow to be able to say “I have one hundred thousand dollars, and if Goldman Sachs (in the 00’s) can create money through leverage at 41/1, I can too.”

Creating and lending money is a valuable perogative, one worth defending.

And what if everything goes wrong? What if, despite all your money, and all the defenses you’ve bought, you lose everything anyway?

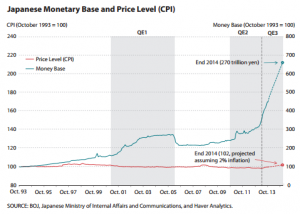

Be clear: This is what happened in 2007 and 2008. If you take into account counterparty risk and you mark assets to market (value them at what they could be sold for), every bank and major brokerage in the United States, and probably all of those in Europe, was bankrupt.

Bankrupt. Even the ones who made the right bets, like Goldman Sachs: because if all their counterparties go under, so do they.

This sort of risk, the kind that is backed up by the full credit of the United States, requires owning government. It requires knowing the central bank is yours and will act to save you.

The first thing a capitalist does when he or she gets rich enough, is buy the system.

They do this for three reasons: 1) to secure their current privileges; 2) to provide a backstop in case of disaster; 3) to create new opportunities.

The consequence of these actions is to drive up prices and keep out competition. It is explicitly to reduce competition, because competition is a danger. The fewer entities controlling more of a market, or controlling politicians, the more money is made and the more secure the current (and future) fortune is.

What this does is destroy the future. To those who are currently in power, the future cannot be allowed to happen until they control it: until they are the ones who will make a profit from it.This doesn’t mean all distruptive change is impossible. There are, even today, many factions amongst the rich: Wall Street, Oil, Silicon Valley, etc.. They have interests in common, and cooperate around those interests, but they are competing to see who will control the future.

This doesn’t mean all disruptive change is impossible. There are, even today, many factions amongst the rich: Wall Street, Oil, Silicon Valley, etc.. They have interests in common, and cooperate around those interests, but they are competing to see who will control the future. Largely, they agree on the basics–things like continually extending copyrights, for example, or free movement of capital, or making regulations so that government can’t enact laws which would make their business go away. They agree about low taxes on capital and low wages (Apple and other Silicon Valley companies conspired to keep engineer wages low by not bidding against each other). They agree about unions not being too powerful.

Anywhere Capital has consensus, if they have been able to buy the system, it is virtually impossible to do anything against their consensus.

Gays have rights because it’s not important to most rich and powerful people that they don’t; and it is important to some of them (say, Tim Cook) that they do.

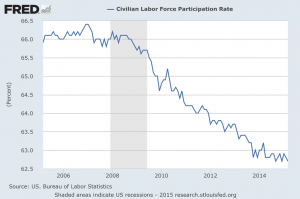

Effective wages have stagnated or dropped for over 40 years now because it is important to most rich and powerful people that they do; your wages are their costs.

Unions have lost massive power because rich and powerful people find that in their interest–even those in industries without unions want them kept weak so they will never have unions.

Concentrated wealth quickly turns into concentrated power and concentrated wealth will always be inimical to widespread prosperity. Wealth is power when it is concentrated. Wealth that is not disproportionate is not power. If it is not power, it cannot protect wealth.

If you allow any group, especially any small group, to obtain disproportionate wealth, they will always use it to protect their wealth.

Part II will discuss how the drive for further wealth leads to the vast impoverishment of everyone outside the wealthy and a small retainer class. Part III will discuss how moderate concentration of wealth can lead to general progress for everyone.

If you enjoyed this article, and want me to write more, please DONATE or SUBSCRIBE.