The invisible hand is the idea that people operating based on their own self interest in a market economy will optimize “value” and by doing so will increase human welfare. If a person runs a company which makes something that people are willing to buy, they must want or need that thing, and the person will want to make more of that thing so that they can become richer. They do it out of greed, but the richer they get the more they improve the common weal, as it were.

So even though they aren’t doing what they do because they care about the welfare of others (Adam Smith is very clear about that) operating from greed leads to increase human welfare.

Works, except when it doesn’t.

Descriptive statements describe how the world objectively is. Prescriptive statements describe how the world ought to be.

It is certainly possible for someone to get rich doing good. It is also possible for them to get rich doing evil, and it is quite common for them to get rich doing both good and evil things.

Oil companies produces something people want. Oil, natural gas and coal have lead to a large chunk of the world being much better off. But the oil companies knew about climate change and not just suppressed the information, they funded denialism, for the obvious reason that they would make a lot less money if there was a political consensus that less oil and gas and coal had to be used.

Every company wants cheap labor, to reduce their costs, but wants consumers to buy their goods. This led to the Great Depression, in effect (the story is a bit more complicated but this is the essence), and was only fixed when the government forced them to give good wages to employees, and provided price and wage supports along with social security and medicare for old people who couldn’t work, but could continue consuming.

All companies who provide necessities, things people must have, have the ability is they are a monopoly or an oligopoly acting in a collusive matter (which doesn’t require meeting) to raise prices much higher than is good for human welfare. This includes food, water, housing and medical services, among others.

Many companies produce what economists call negative externalities: they do something which hurts other people, but don’t pay the cost. Right now in Britain, privatized water and sewage companies are paying record dividends while dumping record amounts of waste into Britain’s waterways.

Walmart and Amazon both tell their workers how to apply for food stamps and other benefits: they take the profits from cheap labor and dump much of the costs onto the government.

Positive externalities are as big a problem: you do something good and someone else gets the profits, so you have trouble doing more good or even continuing to do good. I like to use the example of the British Museum: without them many people wouldn’t come to London or stay as long, but almost all of the money is spent in hotels and restaurants and the British Museum gets almost none of it, even when you consider the government funding based on taxes it receives.

Universities are another classic: they produce a great deal of value, but are able to capture almost none of it. A good government keeps them well funded and emphasizes teaching and research not administration because they know that universities create value the government will eventually capture.

In dozens of ways markets actually incentivize acting in ways that don’t lead to human welfare, but they can improve human welfare. That’s the issue. It isn’t automatic. Sometimes it works that way, sometimes it’s nothing but oligopolies grasping an excess share and companies dumping their costs on society while taking the profits.

So the invisible hand making greed work to the benefit of all is prescriptive: it is a way that an economy with markets can work, not a way that it must work. If you want the invisible hand to do what Smith said it would, you have to stay right on top of capitalists and make sure that the can only get rich if they increase human welfare.

To a large extent, in the New Deal and post-war American period, that’s what government did. Once Reagan took over, it didn’t, it did the opposite because a rich middle class with a lot of money was like sheep in full coat waiting to be sheered for wool, then eaten.

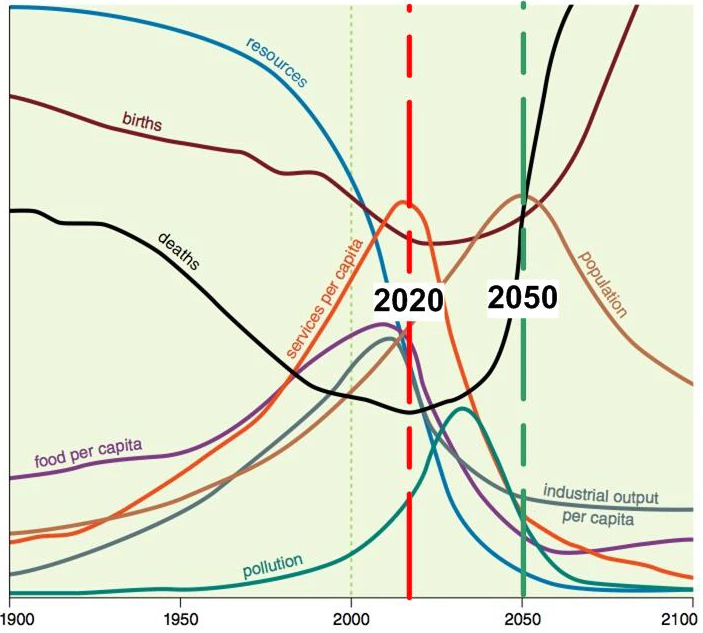

Most economic issues are politics in drag and the vast majority of politics is just about power and coalitions. The remaining economic issues are about natural laws: ecology, geology, physics, biology: mother nature bats last and she doesn’t give a damn what happens to stupid humans or any other species.

All economic systems are prescriptive. “This is how the economy should work” and are descriptive in the sense that if the economy is organized according to the prescription, it is expected to produce certain results.

Capitalism can, for certain periods and places, produce increased human welfare. But it’s not automatic, it requires keeping capitalists under firm control. Capitalists, as it were, make fine servants, and terrible masters.

My ability to write these articles depends on donors and subscribers so if you value this writing, please DONATE or SUBSCRIBE