Though newer readers will be forgiven for disbelieving it, during my early online career I was primarily considered a finance and economics blogger, though I’d write about almost anything. Among other things, I predicted the financial collapse, including the DOW bottom and the month it would happen in. A correspondent once went thru the Wayback machine and found that there were less than forty people who made the prediction in advance.

I lost interest somewhere around 2010 and moved my primary focus to other topics: at the time mostly ideology and how it interacted with the political economy. There was no reason in continuing: my goal had always been change, and the Fed, Congress and Obama had all confirmed that the only change was to be the end of any real spar of capitalism.

So I’m not going to write about the proximate cause of the current financial collapse, but instead look at the bigger picture that lead here.

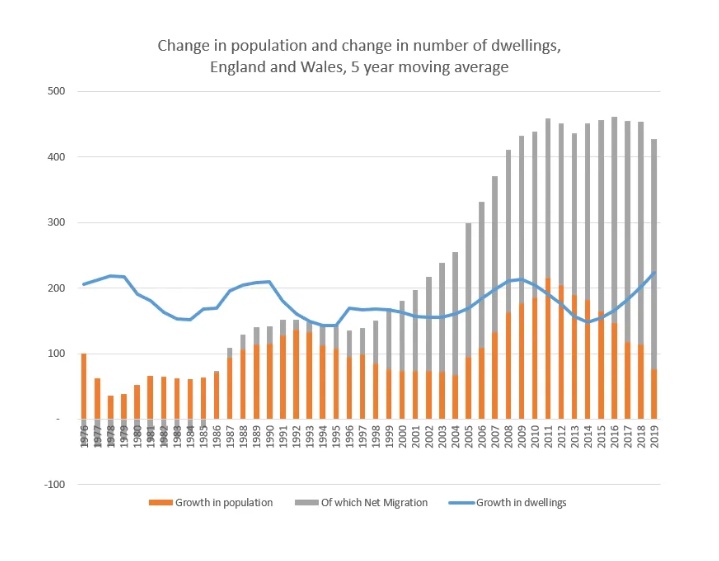

First we have the offshoring of real industry, primarily to China. There is a real economy, and financial skyscrapers, no matter how high, are based on them. The bottom line is that the West no longer has the industry to hold up the skyscraper.

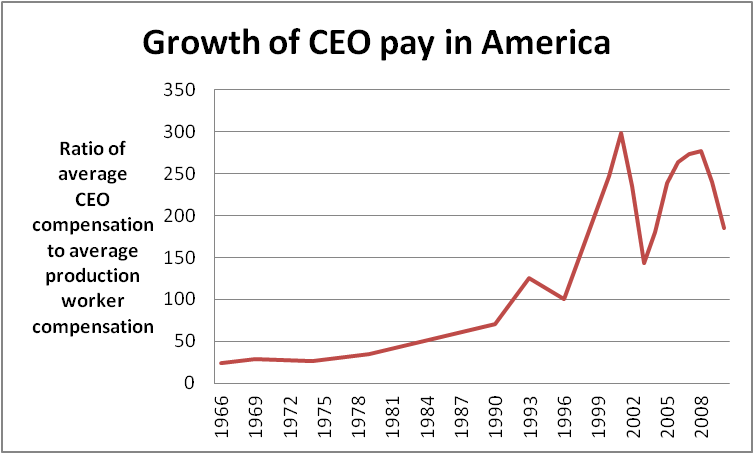

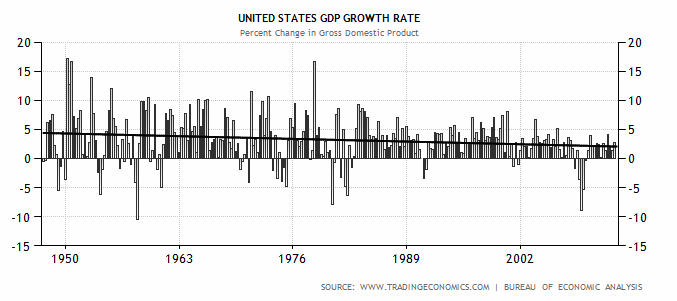

Second is that the 80-now long bull market was entirely a creation of government policy: mostly thru the Federal Reserve, but with serious assists from Congress and the President. There was a time when stock buyback were illegal, for example. There was a time when the Fed didn’t run a “the markets must always go up” policy: in fact, during the 50s and 60s the stock market traded sideways, even though real economic growth was, by every measure, higher than in the post 80 period.

Third is the response to the 2008 financial collapse. Not the collapse itself, but the response, which was to bail out the people and institutions which had caused the crash, to immunize thru fines and agreements those who had engaged in massive and widespread fraud, to force the burden onto homeowners by allowing banks to steal houses; and in general terms to ensure that the same people who had caused the crisis were in charge afterwards, but more powerful and controlling larger institutions.

Then they patted themselves on the back and said they’d saved the world. Capitalism isn’t a system I like, but one of its virtues is that if you fuck up you go out of business: if you’ve made a lot of bad decisions you aren’t allowed to keep making bad decisions. Bernanke, the Fed, Congress and the Presidency put an end to that dynamic and essentially ended even the shadow of real capitalism in America, and indeed, in the West.

This meant that resources were terribly misallocated, and that further economic decline was inevitable, since there was no possibility of a new economic elite rising based on actually producing good products and solving real problems. It also mean that further financial crises were inevitable, and that in the end those crises would not be able to be papered over, because, Virginia, there may be no Santa Clause but there is a real economy where things have to actually be made and built and grown and dug up and refined.

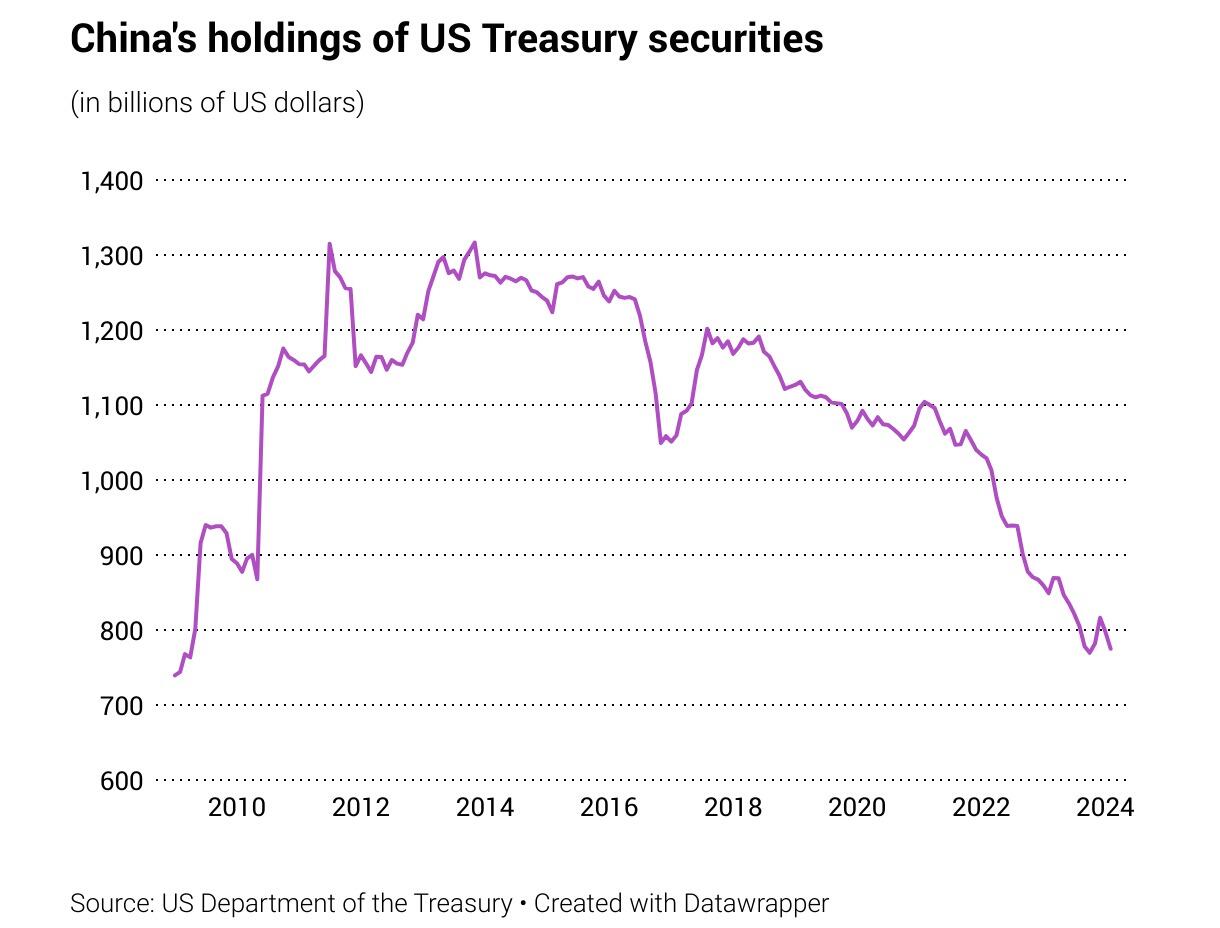

The fourth factor is the decline of US dollar hegemony. It isn’t obvious in the numbers yet, but it’s real and those who are making long term bets against it will regret doing so. I won’t go on about this, since I’ve written a dozen articles or so on the topic in the last two years.

We’re at the end of somewhere between two and five centuries of European/Western world superiority and dominance. It’s going to suck for Europe, the Anglosphere and most of our allies. There’s just no way around that, and the decision points are past. A recovery is theoretically possible, and I could even write an article giving the outlines of what’s necessary, but there’s no political possibility of doing it and our current elites are too incompetent to make it work anyway. A revolution which throws out our entire leadership class is a pre-condition and by the time we got that done, the day would have passed anyway.

All of which is, I suppose, just a long way of saying “economic decline sucks and isn’t going to stop,”

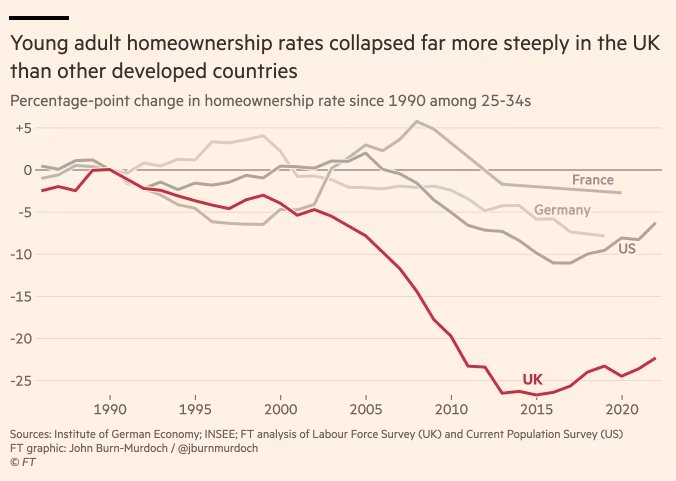

Ouch. I mean, it’s not like the situation is good in the US, is it?

Ouch. I mean, it’s not like the situation is good in the US, is it?

As for Biden, his claims to success are based on statistics that only a toddler or an economist would believe reflect reality, leaving aside the fact that he’s overseeing the loss of the US dollar as the primary trade currency, which will hurt the US worse than an Israeli shoving a red hot metal rod up a Palestinian civilian’s ass.

As for Biden, his claims to success are based on statistics that only a toddler or an economist would believe reflect reality, leaving aside the fact that he’s overseeing the loss of the US dollar as the primary trade currency, which will hurt the US worse than an Israeli shoving a red hot metal rod up a Palestinian civilian’s ass.