The big news yesterday on the financial front was the Independent’s claim that Gulf Arabs and France, Japan, Russia and Japan were planning to move from buying oil in dollars to buying it in a basket of currencies, including gold and a new universal currency shared by the Gulf nations.

Buying oil in dollars is one of the foundations of the dollar’s role as the world’s primary reserve currency. Because the the dollar is the world’s primary reserve currency Americans have been able to borrow money for significantly less than other countries are able to. This has both made America more prosperous, and through the perverse incentives of cheap money, helped lead to the high indebtedness of American citizens and the financial crisis.

In addition, buying oil in dollars is one of the things which allowed strong dollar policies to drive the price of oil down. Making dollars extremely scarce in the 80’s and nineties was one key factor leading to a price per barrel under $20. Oil prices started their rise upwards after Greenspan’s Federal Reserve let loose the money spigot in the Asian crisis and the Long Term Capital fiasco. Greenspan essentially never took his foot off the pedal from that point onwards, and oil prices soared, until last year at one point they were over $150/barrel.

So one consequence of going off the dollar is that a major benefit of the strong dollar play is taken off the table, and the US loses its ability to control the price of oil. Since at this time, contrary to what the Feds are saying, a strong dollar play isn’t in the cards (the US needs to borrow way too much money) that’s not a big deal in the short run—in the long run it is.

But buying oil in dollars isn’t the only thing that underpins the dollar as the world’s reserve currency and to understand what buying oil in something other than dollars would mean we need to understand what else makes, or perhaps more accurately, made, the dollar so important.

Technological Revolutions: Remember the internet boom of the nineties? Remember the way that money flooded in from the rest of the world to buy up internet stocks? Sure, most of them turned out to be worthless, but some didn’t. When the US was the nation most likely to create the next technological revolution you needed dollars so that when it occurred you could buy in on the ground floor. Whether microcomputers in the 80’s or the internet in the 90’s, odds were that America was going to create the next big tech. So foreigners needed to be in the dollar.

At this point the US is the undisputed leader in almost nothing except military tech. As expected, US dominance of the arms sales market continues to increase, but the US can’t live on weapon sales alone. In most other fields, including telecom, the internet, large chunks of biotech, renewable energy, ground transportation and so on the US now lags other modern economies.

The structure of the US economy, with a few large oligopolistic firms dominating the market in key fields needn’t necessarily mean no technological advances, after all Japan and Korea certainly have high concentrations of large firms, but US firms such as the telecom giants essentially don’t engage in research, don’t believe in upgrading infrastructure more than they have to and are rent seeking corporations—they provide an inferior product to a captive audience (as with insurance companies) knowing that Americans have no other options. If they fail, they expect the US government to bail them out with huge subsidies.

This structure means that the US, is unlikely to be the home of the next great technological revolution. The next tech reveolution could happen in the US, with the right policies, but the Obama administration has not engaged in those policies, instead spending trillions on propping up failed business models.

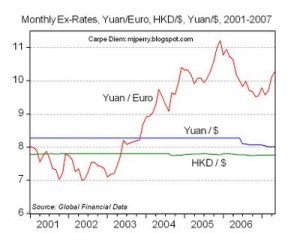

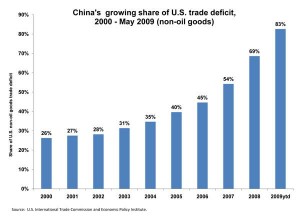

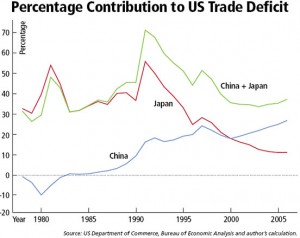

Consumers of Last and Main Resort: For decades now Americans have bought a ton of consumer goods, from cars to electronics to clothes. As time went by, more and more of these goods were bought from foreign countries, and more and more of it was bought on credit. America and Americans have been the engine of development for Japan, the Asian Tigers, and most recently, China. China, Japan and Korea, in particular, used mercantalist policies—that is to say they generally used trade barriers to protect their internal economy and subsidies to help their exports. China’s main trade barrier and subsidy is its massive interventions to keep the Yuan cheap against the dollar, an intervention which has amounted to as much as 10% of China’s GDP.

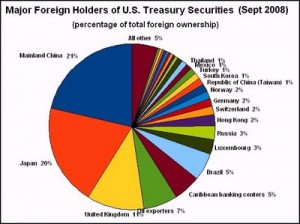

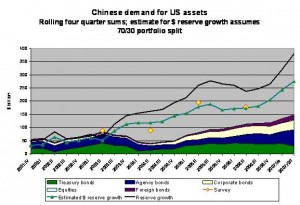

That intervention has left China with a huge number of dollars denominated assets. In effect the Chinese loaned America the money to consume Chinese goods, which simultaneously made American manufactured goods uncompetitive which meant that manufacturing employment in American dropped like a rock while new factories opened in China rather than the US. In exchange for the money they loaned America, China industrialized. Even if they don’t get most of the money back (and they won’t) it was a good deal for them. As for Americans, well, Americans were able to live above their means—those who didn’t lose their jobs, anyway.

Many countries export a lot to the US. While US consumers have pulled back significantly, they still consume a lot. There is, as yet, no replacement for the US consumer. China and other countries may wish there was, but there isn’t.

The American Security Product: One of the main reasons other countries were willing to, in effect subsidize the US, for decades, is that it provided the common security product—against the Soviets, then against real rogue nations, and always against pirates.

In particular, America’s navy is as large as the next 13 navies combined. The US was responsible for keeping the world’s shipping lines open, and it was the core of the NATO hammer when a problem needed to be dealt with (for example, Serbia in the late nineties.)

But lately the US hasn’t been delivering the product in a way that the rest of the world appreciates. Most of “old” Europe (ie. the countries with money and power) opposed it. So did most of Asia. So did America’s allies in the Middle East. Once in Iraq, the US couldn’t be defunded for fear of Iraq splintering, but now that it’s clear the US is leaving anyway, the possibility exists.

And then there’s the Somali pirates. Because most of the US navy was occupied with the wars in Afghanistan, Pakistan and Iraq, the Somali pirates got completely out of hand and the US Navy didn’t do anything about it for a long long time. When the issue was finally dealt with, the US navy was only one of a number of navies doing so. The US let it get out of control, and then wasn’t key to fighting it.

Now that the US no longer protects very well against the Soviets, rogue nations or pirates, and now that joint naval operations are how the Somali pirates are being dealt with, the rest of the world is wondering whether it’s worth paying for a US military which doesn’t do what they want it to do. Only the Afghan war, which has elite support in Europe (though not popular) makes some think that perhaps the US is worth keeping on as the world’s policeman.

Buying Key Technologies Took Dollars: Yet another reason folks wanted to have lots of dollars and access to dollars was that you needed dollars to buy certain goods. For decades the only good commercial jet liners were Americans. Key computer technologies needed to be bought in dollars. Intellectual property needed to be bought in dollars. The best military technology had to be (and still has to be) bought in dollars. And so on. The US wasn’t just home to the next technological revolution, it was home to all the good things you wanted to buy and which you couldn’t buy in your currency.

This is, with a few exceptions, no longer true. The Europeans and Japanese can sell you most high end capital goods. There is no real difference between Airbus and Boeing products (though both are essentially 30 year old technology). The Chinese can and will sell you middle and low end goods for less than America. You don’t need dollars to buy most of what you need and want, and if something comes up really worth buying (say General Motors) well, if you’re someone who really wants it, like the Chinese, you just won’t be allowed to buy it anyway. (The Chinese would have loved to buy GM.)

A Safe Haven For Money and For You: For decades, if you wanted a safe place to put your money and put it to work, the US was probably the best. It was the most stable, it was impossible it could be conquered even if there was a World War III, it was the largest and could absorb the most money. Likewise, if things went really bad in your country, it was a great place to flee to.

The financial crisis put the wisdom of placing your money in the US in question. Bush era immigration and travel policies, not rescinded by the Obama administration, put the utility of the US as a safe haven in question as well. And yet, to an extent, the US retains at least the first role, because there is simply no other country available. Europe did not avoid the financial crisis, China doesn’t allow that much investment in the country and is an unsafe place to put money, and so on. So the US retains some safe haven appeal. At the same time, however, foreign elites have become far more uneasy about the idea and want a different option. And for themselves, they’d rather vacation, have their second homes and educate their children in Europe.

And at last, back to oil: Of course, the final and in some ways most important reason for the dollar’s reserve currency status is that oil was sold in dollars. This is a result of a decades long understanding between the key Gulf States, Saudi Arabia and America that the US both underwrote their security and could knock them over any time it wanted. In exchange for America’s security umbrella and help in maintaining their regimes, oil was priced in dollars. When they became rich in the 70s, their money flooded primarily through US banks.

Indeed, in prior years, every time an OPEC nation talked about going off the dollar as the currency for buying oil, rumor has it that the Saudis were the ones to spike the move.

Oil is the most important commodity in the world. Ultimately all economies are underpinned by oil. Oil is also the most important military resource. With oil your army can move and fight. Without it, it can’t. In many ways WWII was fought for oil and with oil, and the powers with the oil defeated those which didn’t have it.

Which brings us back to the US military product. As long as oil is priced in dollars, the US military can always function at full capacity, because if push comes to shove, the US can always just print more dollars.

If oil is not priced in dollars, then certain US access to oil is removed—both for the military and for the civilian population. Sure, the US can still print more dollars, but if oil isn’t priced in dollars, well, print too much and you may get inflation, even hyperinflation. And if the oilarchies don’t approve of a particular military action, well, they can make it much more expensive.

Are the Dollar’s Days as Reserve Currency Over?

No. They aren’t. But they are numbered. They aren’t over because other nations still need the US consumer. Until the Chinese manage to create a domestic consumer society, both they and other countries can’t cut themselves lose from the US consumer. What they will do, and what they are doing, is trying to manage how much the US borrows and to take away the US ability control the world’s money supply. They will still have to keep the US propped up for the time being, because in so doing they are propping up themselves. And remember always that Chinese citizens aren’t like Americans. Take their jobs or their land or their hope and they get violent—very violent. They have, do and will fight both the police and the military. China’s elites know that if they don’t keep economic growth coming, their heads could literally wind up rolling.

In addition, while no one is happy with the US security product, the fact is that no one can really replace it. The European military is not strong enough, and their navy does not have the projection ability. Likewise with the Chinese military, who in any aren’t trusted half as much as the Europeans, though their moral flexibility is appreciated by many regimes, who still understand you don’t invite China to station large number of troops in your country if you have half a brain.

Likewise, there is simply no replacement for the US as a haven of last resort. China’s currency and investment controls make it unsuitable. Europe managed its financial affairs no better than the US over the last decade, although they seem to have learned the regulatory lessons marginally better than the US. If you need a place to store your money, and put it to work, the US may not look good, but neither does anyone else who is large enough to absorb large amounts of money.

The key break point, the end of the dollar hegemony, will come when the Chinese are able to move to a consumer economy. At that point, the Chinese will no longer need America as consumers, and they will let the Yuan float. The devastation this will wreck on the US economy is hard to overstate. Standards of living will crash. In the long run, being forced to live within its means, and no longer having to compete against massively subsidized foreign goods may turn out to be good for the US, but that won’t make you feel better as your effective income collapses or you lose your job.

This is probably two economic cycles out. We’re talking 12 to 16 years. So there’s time yet. Probably.

So what does oil not being priced in dollars mean to me now?

Less money for everything. The US will not be able to afford as large a stimulus as it should have. It will mean borrowing costs higher than they would otherwise have been and more restricted credit (sure, theoretical interest rates may be low, but can you get a loan at those rates?) Oil prices, and gas prices will be more volatile for the US than they were before, which is saying something.

And other countries will get more oil, relatively speaking. Which means they will get more growth. They will receive more investment from the oilarchies, and the US will receive less. Relatively speaking the US economy will not be as good as it was. This is a marginal effect, but marginal effects add up.

This is, in short, not good news. You won’t be able to say “I lost my job because oil isn’t priced in dollars” but it will be true for some people. Lower wages, more restricted credit, and more restricted government policy will be the price paid for the massive incompetence which lead to this moment.

And yet this does have a silver lining. Both for other countries who deserve to be able to pay in their own currencies and for America and Americans, who need to learn to live within their means, to emphasize production again rather than consumption and who need to wean off of oil as much as possible in any case.

But it will hurt.