This is a complete capitulation:

- 15% tariffs on EU goods, 0% on US goods

- EU to buy 750 billion dollars in LNG over the next 3 years (US LNG is more expensive than alternatives)

- 600 billion EU investment in the US

- 50% tariff on steel and aluminum to the US stays in place

- A commitment to purchase huge amounts of US armaments

Japan has similarly capitulated, after previously standing firm.

Pathetic.

Ironically this leaves Canada as one of the only holdouts among America’s vassals. China, of course, has told the US to take a long flying leap off a short pier.

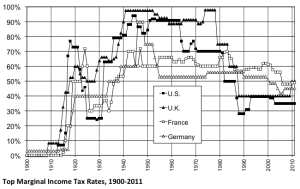

As I have noted before, the US has been cannibalizing its allies as it declines. This was true under Biden. Trump is only super-charging it. This cannibalization won’t change the trajectory, the US is DONE, but other countries accepting it means they will go down with the US

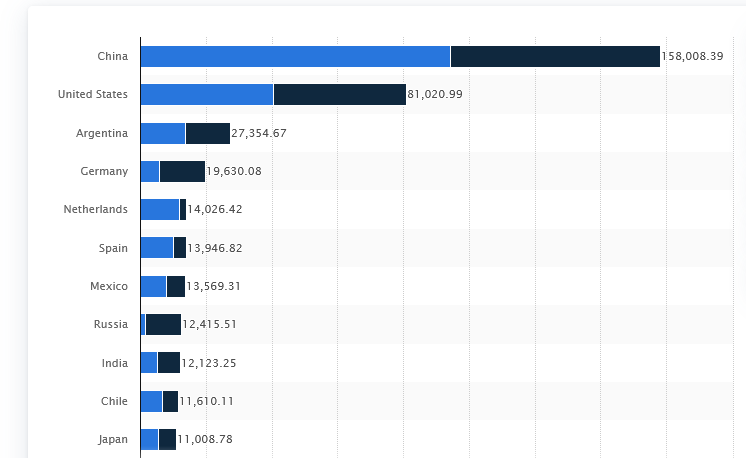

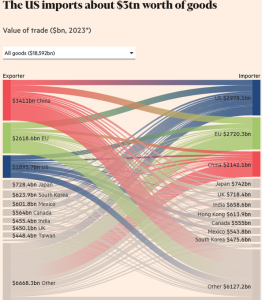

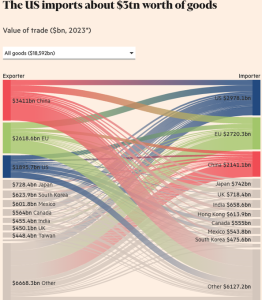

The EU was always in a hard place: it does export much more to the US than vice-versa. But it did have options, it just refused to take them. Cheaper energy from Russia is available, even during the war, Putin has been clear about that and it would mean much slower de-industrialization. Germany’s loss of industry has been, in particular, driven by high energy prices since the Ukraine war and the destruction of Nord Stream. German businesses which shut down in Germany have often moved to the US for the cheaper oil prices.

The way to strike back against the US was to hit America services: internet companies and break various copyright and patent laws. Hit the tax havens and take the money. (Ireland will squeal, but so what). This is where America really makes its money and it’s completely vulnerable. Meanwhile cut a deal with China, they’re the rising power.

The same is true for Japan, as it happens.

As Trump has shown, no deal is final. When politics change in Europe (and they will) this deal can be repudiated as the garbage it is. If that doesn’t happen soon, Europe’s decline will be much faster than it has to be.

What’s particularly interesting to me is the psychology of this. European elites are just so used to being vassals, and so completely without any pride (though they have plenty of vanity) that they are unable to stand up to America no matter what the humiliation. Russia was able to withstand far worse than what the US was doing, and even flourish, but Europeans can think of no way out but to capitulate. (To be sure, Russia had certain advantages the EU doesn’t have, but the reverse is true as well. The real issue is a lack of imagination and guts.)

Europe needs to get rid of its elite class, entirely, and find new leadership. Unfortunately it seems likely that they’re going to choose the idiot right, who will simply overcharge decline. After those morons fail, they may finally turn to decent leaders, but by then it will be too late to “save the garden” in most nations.

This capitulation has closed off one option: the third bloc. What could have happened is Europe, Canada, Mexico, Japan and other affected nations forming a unified trade bloc of their own, and taking unified steps against America. Such a coalition would have won the ensuing trade war and could have cannibalized the US rather than the other way around.

It is a pity, but unlike many historical vassals who resent their status, our current leadership seems to enjoy being house slaves. So all of this will be done the hard and ugly way.

If you’ve read this far, and you read a lot of this site’s articles, you might wish to Subscribe or donate. The site has over over 3,500 posts, and the site, and Ian, take money to run.

Well, maybe. Who the hell knows what he’ll do. Anyway, tariffs are back to 30% on China and 10% on America.

Well, maybe. Who the hell knows what he’ll do. Anyway, tariffs are back to 30% on China and 10% on America.

The final part of the economy is what you can get from other nations. Call this the external economy. Does someone else make it, will they sell it to you, can you afford it? Most of the time countries won’t sell other countries nukes, for example, and for much of history countries tried not to sell other countries the knowledge required to make advanced techs. When they didn’t prevent this, they paid big time: Britain was de-facto subjugated by America and America is now losing its Empire.

The final part of the economy is what you can get from other nations. Call this the external economy. Does someone else make it, will they sell it to you, can you afford it? Most of the time countries won’t sell other countries nukes, for example, and for much of history countries tried not to sell other countries the knowledge required to make advanced techs. When they didn’t prevent this, they paid big time: Britain was de-facto subjugated by America and America is now losing its Empire.