If you look up whether governments can “just print more money,” what you’ll find at most sites is the answer, “No, because it only increases the amount of money, not the amount of economic activity.”

This is not true, and it’s not true in a number of ways.

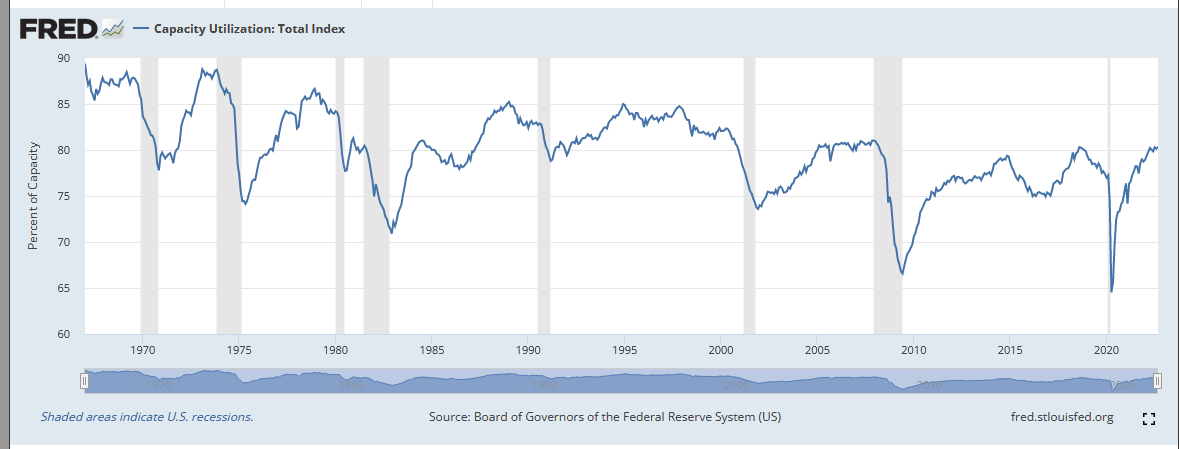

If there is under-utilization of capacity, you can print. Here’s US capacity:

The US has been running substantially under capacity for a long time.

But, you say, there was a lot of money printing (private and public, most money is created by banks, brokerages, and so on), and capacity utilization didn’t go up. In fact, it went down.

Well, yes, because the money went to other countries like China, where it increased capacity vastly, or it went into assets (the housing bubble, stock bubbles, and so on), or it bought private jets and yachts and so on.

Which is to say, it’s not just about money creation; it’s about who gets the money. Since virtually all the money creation of the past 40+ years has gone to rich people, capacity has been created for what they want. And because it was cheaper and more profitable to build capacity overseas, that’s where the money created went.

OMG THE CARNAGE!!! pic.twitter.com/1HEKwmTX7w

— Rudy Havenstein (Checkmark Goes Here) (@RudyHavenstein) November 2, 2022

In addition, there’s the fact that the US dollar is used to buy oil and is the general medium of exchange in most foreign trade. It’s also the “gold” currency, in that during crises it tends to go up, so people want to hold a store of it against bad times.

All of these factors are contingent. If oil was not sold primarily in dollars, or trade settled in dollars, for example, there’d be a lot less demand for dollars. If the trade regime didn’t allow for vast imports and exports, but the world was more autarchic, then building new industry overseas wouldn’t make any sense, and so on.

This is to say, nothing is eternal. The dollar’s position is a historical artifact, based on specific circumstances which did not, and will not, always exist.

Remember, there was a time when the center of the world economy was Britain (chart from Mike Todd).

What you see in that chart (and it’s going to keep getting worse) is the switch from London to New York; from the pound to the dollar, because the pound wasn’t the primary international currency any more AND (and this is important) the UK kept de-industrializing so there was less and less relative demand for its products, though the City of London retained an important financial role, which kept the pound higher than the economic situation of Britain would otherwise have allowed.

Developing countries, as a rule, cannot run the printing the press because people only want enough of their currency to buy whatever goods and services they produce. In addition, because most Third World countries have vast import requirements (more so as time has gone on), and their agricultural bases have been destroyed, printing money causes inflation very fast. It’s not just an internal matter, more money chasing goods, it’s that people try and use the new money to buy goods produced externally, and their exchange rate collapses.

When the US prints money, a lot of it goes into other countries reserves and the reserves of people and companies. It pools, as it were, uselessly, and to the extent that it is “more money chasing the same goods,” its effect is spread over most of the world and not just internally.

Once this was true of the British pound.

The original conception of comparative advantage was based on the assumption (true at the time) that money mostly pooled inside countries and could not be used to create production in other countries. If Britain produced less widgets because French widgets were cheaper, the money freed up in Britain would go to produce something in which they had a comparative advantage, say woolens, instead of fleeing overseas. (See Ricardo’s Caveat for the long form of why comparative advantage doesn’t work with free capital flows.)

Now, you can also print money if you give it to the useless classes, i.e., the rich. In that case, it drives bubbles (see the SPX chart above or art prices) or creates niche markets, like yachts and private jets. It doesn’t drive general inflation, it only drives inflation for what useless people want.

Unfortunately, that inflation does eventually cause various crises, but for a time, it seems “free” — you make the rich much richer without causing widespread inflation.

What matters, then, is who you give the money to, and what they spend it on. Volcker crushed wages because, in addition to wanting to make useless people richer, he didn’t want ordinary people to have more money because they would spend it on things which lead to buying more oil, and given oil prices at the time, that would lead to more inflation. He needed to smash oil prices, and he did so by smashing wages to smash oil demand.

If you print money and give it to ordinary people, and it just leads to them buying more stuff from overseas, it won’t move that capacity utilization number you see in the chart at the top very much.

But this isn’t to say that printing money doesn’t “work.” It does work. It always does something. Someone benefits. If you print a bunch of money, and make sure it goes to ordinary people in your country, and that your country increases utilization and/or increases how much it produces, then it can produce a general wave of prosperity. After all, when wages rise higher than the cost of goods and services, that’s prosperity, but companies don’t like that unless they’re still making more money because they’re selling more overall.

(That last sentence, by the way, is the secret of the post-war good era. Meditate upon it.)

You lose the power of the printing press when no one wants your currency because you can’t produce enough, or increase production, AND it isn’t necessary for other things (like international trade).

This goes in stages. Britain, outside of the EU and with less and less industry, and with less reason to send money to the City of London, is in danger of losing the power of the printing press in the way Third World countries do. “There’s no reason to buy any more of this than however much you need to buy their goods.”

At that point, you need to figure out how to re-industrialize and under a free trade order like the neoliberal one, that’s hard. Every time you try, money floods out of your country instead of increasing activity inside of it.

As for the US, it’s in an extraordinarily privileged position, but as China and the BRICS move to conduct more and more trade without dollars, and as trust in the US to run the international monetary system drops and drops due to repeated sanctions and thefts of reserves, that privilege will decline, and the US will find more and more that if it wants goods from another country, it will need to provide not dollars (though they may still be exchanged), but actual goods and services itself.

If you can’t pay with goods and services, you pay by selling your patrimony — companies, land, resources, etc.

The power of the printing press is great, but it can be used for ill and good. It can create real economic growth and widespread prosperity under the right conditions, conditions which are partially under a country’s control. But if you become too weak or poor, you can lose even the theoretical ability to create those conditions. There is essentially nothing most African countries can do to restore enough sovereignty to allow them to use the printing press for good, and if you’re a relatively rich country which does still have the freedom of the printing press, there is always the temptation to use it foolishly or venally, as the US mostly has in recent generations.

Money is a social creation. So is how we run the economy. It can be made to work for everyone, for a few people, or as a machine of impoverishment. The choice, on aggregate, is ours.

Eric Anderson

Ok, for an economic dilettante, that was a serious lesson.

Not even going to try and wax intellectual b/c I’d just wind up sounding the fool.

Thanks for the brain expansion Ian.

bruce wilder

I object to the “money printing” metaphor because it misrepresents the problem of making demand effective through finance as a problem of currency supply. Managing the currency is a wholly separate set of operations from the management of credit and debt creation; the first is necessary but essentially technical in nature — competent agencies supply as much coin and currency as is needed.

The creation of credit/debt as public policy is what the OP is about.

Money finance, where managed responsibly in the public interest, can be a stabilizing instrument of prosperity. What is more likely to happen is that elites will corrupt finance to create artificial instability that aids the transfer of income upward as the lower classes are mired in debt and their lives made precarious.

Soredemos

“If oil was not sold primarily in dollars or trade settled in dollars, for example, there’d be a lot less demand for dollars.”

This is almost exactly wrong, see very recent post on NC.

Tallifer

This was what made Holland powerful enough to break free from Spain, and Britain to crush Napoleon: the power of finance.

bruce wilder

The Petrodollar “myth” so-called is one of a great many variations on the pedantic point that the magnitude of the unit of account does not matter. The philosopher David Hume, who opined on economics like any good figure of the Scottish Enlightenment, famously made this point on his path to an idiotic Quantity Theory of Money. Yves Smith lets Dean Baker make the similar point that pricing in dollars is an arbitrary convention with no great significance of its own. Yves Smith does cling to the bizarre idea that banking and accounting computer programs and systems are deeply entangled with the unit of account, such that any kind of switch is risky and necessarily time consuming.

Once you get past the pedantry, the point emerges that exchange of oil for dollars is deeply entangled with the use of dollars as “the” global reserve currency. I do not see any important problem with “If oil was not sold primarily in dollars or trade settled in dollars, for example, there’d be a lot less demand for dollars” as shorthand for this point: establishing petro exchange which is underwritten by securities and banking systems in renminbi, say, undermines the dollar as a global reserve currency and the U.S. will eventually lose the great economic advantage of controlling the global reserve currency.

At bottom, I do not see that Yves Smith made any point other than some vague hand waves at the point that this change — the eclipse of the dollar as reserve currency — will take a long time and be a gradual erosion. I am not so sure that it isn’t a Seneca’s Cliff situation or a Hemingway bankruptcy: “gradually and then all at once”. Active hostility abroad combined with elite contempt for integrity and self-restraint to conserve the power of the dollar in the U.S. indicates to me that collapse is a very real possibility.

bruce wilder

@ Tallifer

Very good points. Spain relied on its control of precious metals imported to Europe from the Americas and took advantage of the arbitrary power of Monarchs to default on debts.

That pound sterling was a fiat money during the Napoleonic Wars was obscured during the later 19th century when Britain’s elites found it convenient to erect and champion the gold exchange standard to “govern” the global trade and finance system it dominated.

Britain paid a price in the Long Depression of the last quarter of the 19th century, as did many wage-earners and small farmers in the U.S.

It is unfortunate that economic history is so little accounted for.

Jason

Thank you Ian.

Money is a social creation. So is how we run the economy.

No. Money and “the economy” are the creation of those who desire control.

Close-knit cultures and societies had/have inherent levels of “trust” – which itself isn’t a good word to use, because these days it’s most often invoked or advertised from a place of authority which will benefit from it.

Anyway, no medium of exchange is necessary, and certainly none that require payment of “interest” on “principal.”

Meditate on that for a while!

Soredemos

@bruce wilder

You’re even pretending to honestly engage with anything she or Baker said. You’re the one hand waving away the various reasons why trade isn’t going to shift away from the dollar anytime soon. And when it does, it’ll largely be because the US has chosen to self-sabotage the security and reliability of the dollar as part of its mad goal to hurt Russia.

capelin

Didn’t one of the Gulf wars get launched partly because Iraq was about to start demanding euro’s not dollars for it’s oil?

Adam Eran

JFYI, Carter deregulated natural gas prices. That started to end the petroleum shortage that caused U.S. inflation in the ’70s (producers won’t even drill if the costs to secure the petroleum aren’t less than the anticipated price). Warren Mosler says that, not Volcker’s enormous interest rate rises, is what cured inflation. Then Alaska’s North Slope–a very large oilfield–came online in the ’80s.

Ian Welsh

Yes, the idea was to crush wage driven inflation till new sources came online, but also to keep the demand down. Remember that by the late 90s oil was under $20/barrel.

marku52

Related to this, the Cantillon Effect. noticed by a pre revolution Frenchman. He who is closet to the money spigot, like the French courtiers (or today’s financial industry) benefit from the money creation. As you move farther away, say a peasant on the fringes or today’s minimum wage worker, the only effect is inflation, and life gets harder

“With the creation of the U.S. Federal Reserve and the U.S. exiting the gold standard, the Cantillon effect has favored investors and owners over workers (wage-earners) in the aggregate.”

https://www.swfinstitute.org/news/89070/what-is-the-cantillon-effect-and-why-its-even-more-important-now