The US thru a kitchen sink of sanctions at Russia after the start of the Ukraine war, including freezing their foreign assets. The result?

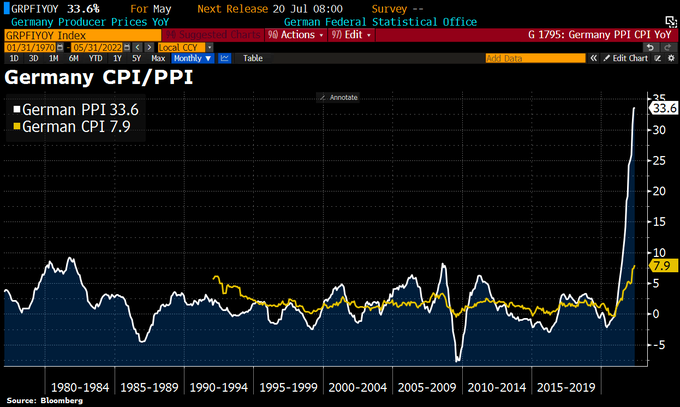

The number is exaggerated, given Russian inflation, but even inflation adjusted, Russia’s doing fine.

It is impossible to choke out Russia with sanctions if China isn’t willing to go a long. (India not cooperating is the cherry on top.) Cannot be done. Impossible.

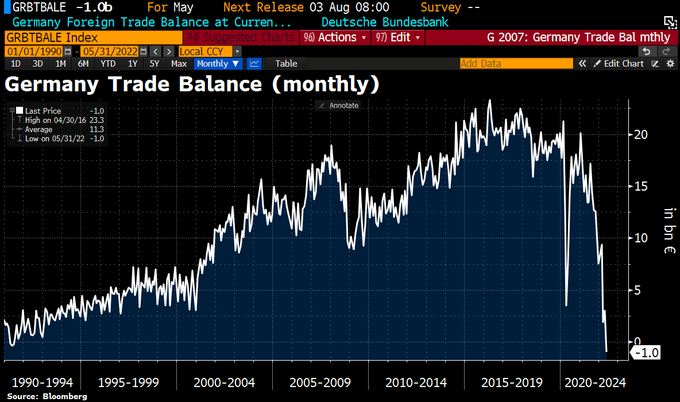

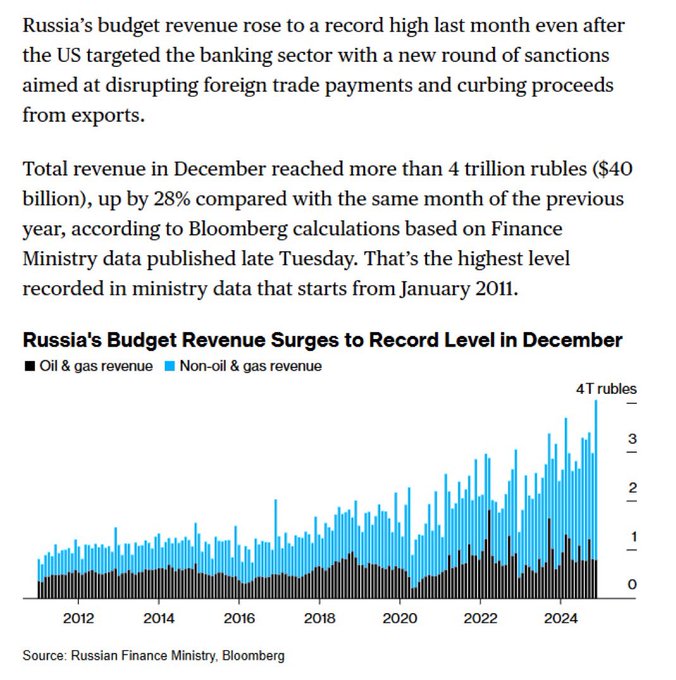

In fact, sanctions against Russia have been a huge favor to it, forcing a vast surge in import substitution, improving its industry, creating a booming economy whose only real problem is inflation. Russian oligarchs have been forced to spend their money and effort in Russia instead of wasting their money in the West. Meanwhile the sanctions have damaged Europe massively, though somewhat to the benefit of America, since much energy-intensive industry in Europe is shutting down and moving to the US.

If Trump wants peace for Ukraine with Russia he’s going to have to offer a good deal. Threats won’t cut it. Or just wait for the Russians to win and impose a peace.

Since Trump appears to be reducing aid to Ukraine, that will happen sooner than otherwise. Perhaps it’s his real strategy, or more likely, he’s simply incoherent. Russia halting along the current lines would be stupid of them, since they’re advancing inexorably and all reports are of significant Ukrainian manpower shortages.

Trump’s always been a bully, but Russia isn’t one of America’s vassals or satrapies. It’s a junior ally in the Chinese sphere, and Trump doesn’t have the economic or military leverage to make it do anything. The only country in the world which can force Russia is China, and China isn’t going to help America v.s. Russia under any likely Trump policy regime.