Let’s deal with the big, almost certain effects first.

This is the beginning of the end of the American alliance system, empire and world economic system.

Trump is planning on putting tariffs on Europe, too. He put higher tariffs on Canada, supposedly one of America’s closest allies, than on China. Hitting the majority of America’s vassals/allies all at more or less the same time, with them retaliating with their own tariffs means an end to the American created world economic system. It will also lead to the end of NATO and, in time, other alliances. Europe’s mainland isn’t practically subject to threat of invasion from the US the way that Canada and Mexico are, they don’t have to put up with this, but threats to Greenland make it clear that the US is more likely to invade an actual EU member than Russia is.

Hard to have an alliance with a nation you’re in a trade war with who is threatening to invade one of your countries and who, by all accounts, is serious about it.

And while the tariffs are all justified on “national security” which is “letter” legal, everyone knows that’s bullshit. Trump is violating the purpose of the WTO, USMCA/NAFTA and other trade treaties the US has signed.

There’s no way the world trade order survives this and no way the American empire does either, since it’s based on an alliance system and bases around the world, many of which are in countries Trump is declaring his trade war on. Even countries who escape tariffs for now can’t feel secure. Ironically it’s the tariffs on Canada which will do the US the most international harm: everyone knows that Canada has been a completely supine vassal giving to the US everything it wants. Canadian exports, minus oil and gas, are less than its imports from the US, so there’s no legitimate re-balancing argument, even. Foreign leaders have read reports making this clear.

Alright, enough about the top-line effects. Let’s look into the theory of tariffs Trump appears to believe.

Trump has nominated Stephen Miran American to be chairman of the Council of Economic Advisers. Stephen is a senior strategist for Hudson Bay Capital management, and he wrote a 40 page brief, primarily on tariffs, called “A User’s Guide to Restructuring the Global Trading System.“

The most important part of his thesis is the following argument about the effect of tariffs.

1) The currency of the exporter will depreciate to make up the difference in cost.

2) Consumer prices will not go up, therefore;

3) the exporting country is damaged, the importing tariffing country is not.

4) But the tariffing country does get revenue! Free lunch, in other words.

5) Importer profit margins take any hits hits not covered by the exporter’s currency depreciation, not prices, or at least they did last time.

This argument is given empirical backing by looking at what happened when Trump imposed tariffs during his first term: the Yuan depreciated and consumer prices didn’t rise.

Let’s run thru this.

- China tends to control the price of its currency. If the Yuan depreciated, it’s because the Chinese government chose to depreciate it. They may not choose to do so this time.

- America has no option but to buy from China. From machine goods to basic electronics to parts for America’s defense industry, there are no domestic or European alternatives for much of it.

- China doesn’t, therefore, have to depreciate its currency. It might sell less goods, but it will still sell tons. It’s a political decision.

- If the exchange rate does drop, or balance, which is not a sure thing, even with non-controlled currencies, then US exports to that country become more expensive, and the exports to that country drop. In the case of Canada, which imports more goods from the US than vice-versa, what is likely to happen is import substitution: Canadian importers will probably switch to China.

- In fact, this will be a general issue. Any country the US puts tariffs on will replace a lot of imported US goods with Chinese goods.

- Not all importers can eat the losses. The reason Trump put only 10% tariffs on oil and gas is that American refiners have thin profit margins. Any increase in crude prices from tariffs will be passed on to consumers. (Aside: this is clearly the Achilles heel and Canada should put an exit-tariff on crude to hurt the US as much as possible.)

- Importers also don’t have to eat the price increases. In the pre-Covid world, there was a lot less consumer inflation. But when Covid happened, prices increased faster than costs because Covid supply shocks were a good excuse to raise prices. Some importers may eat the increased costs, others may pass them on, and even raise prices more than the tariffs. If they have pricing power, if people must buy from them, then why not? Fear of Trump might cause some to eat the difference, but there are a lot of obscure, little importers. Apple passing on costs or gouging will be noticed so they’ll probably eat it. Others won’t.

- The money the government receives comes from Americans, really, not foreigners. They pay the tariffs. There are elites who are going to be hurt by Trump’s tariffs.

What Miran doesn’t talk much about is the idea of import substitution. The real reason to do tariffs is to protect and nurture internal producers. This is important to Trump, he’s talked about it often.

With respect to Mexico, the idea is to get factories in Mexico to move to the US. They exist in Mexico primarily because Mexico used to have tariff free access to America, and has lower costs than America. There will be some effect here. The calculus will mostly be about uncertainty, though, not costs. In most cases producing in Mexico is probably still cheaper, even after a 25% tariff, than producing in America. But given how erratic Trump is, and that he’s indicated there may be more and higher tariffs, it may make sense to move factories to the US. The US won’t tariff itself.

But this is more complicated than it looks, because the US doesn’t make most of the parts any factory will need, so those have to be imported, and tariffed, or a supply network needs to be built in the US.

That’s what the US wants. If you want sell to us, you have to make it here, not just assemble it.

This is fair enough, actually, but it’s based on an assumption of continued dollar privilege.

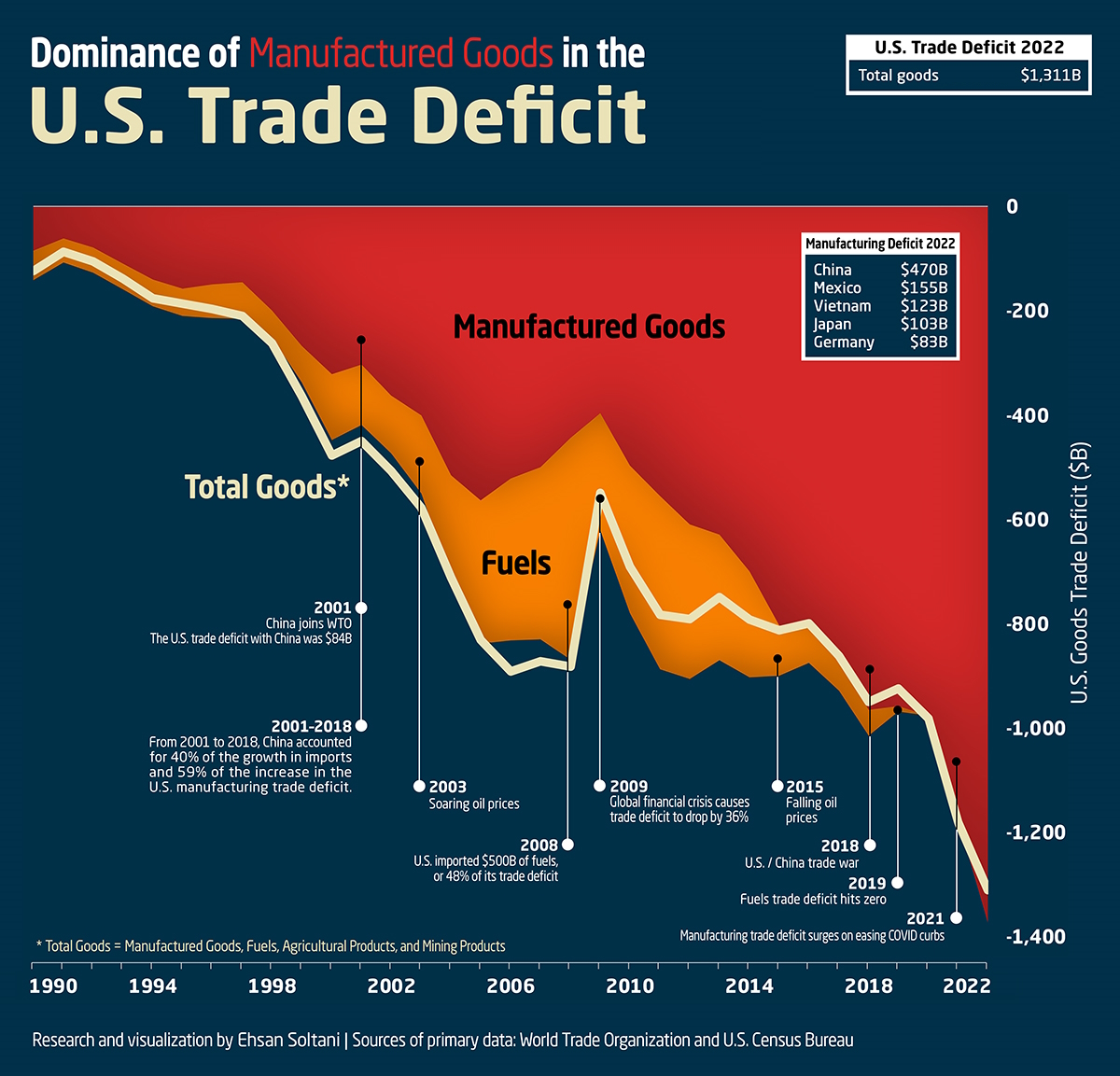

The US is able to run these long term, consistent trade deficits because of dollar privilege. It can print dollars and everyone will take them.

But if the US world economic system is breaking up, if NATO is likely to die, and if the US is tariffing its allies, will dollar privilege survive? After all, you don’t really need dollars to buy from the US, because the vast majority of what you buy from the US you could buy from China instead, and Chinese prices are cheaper. If America doesn’t want you to export to them, well, what good are the dollars?

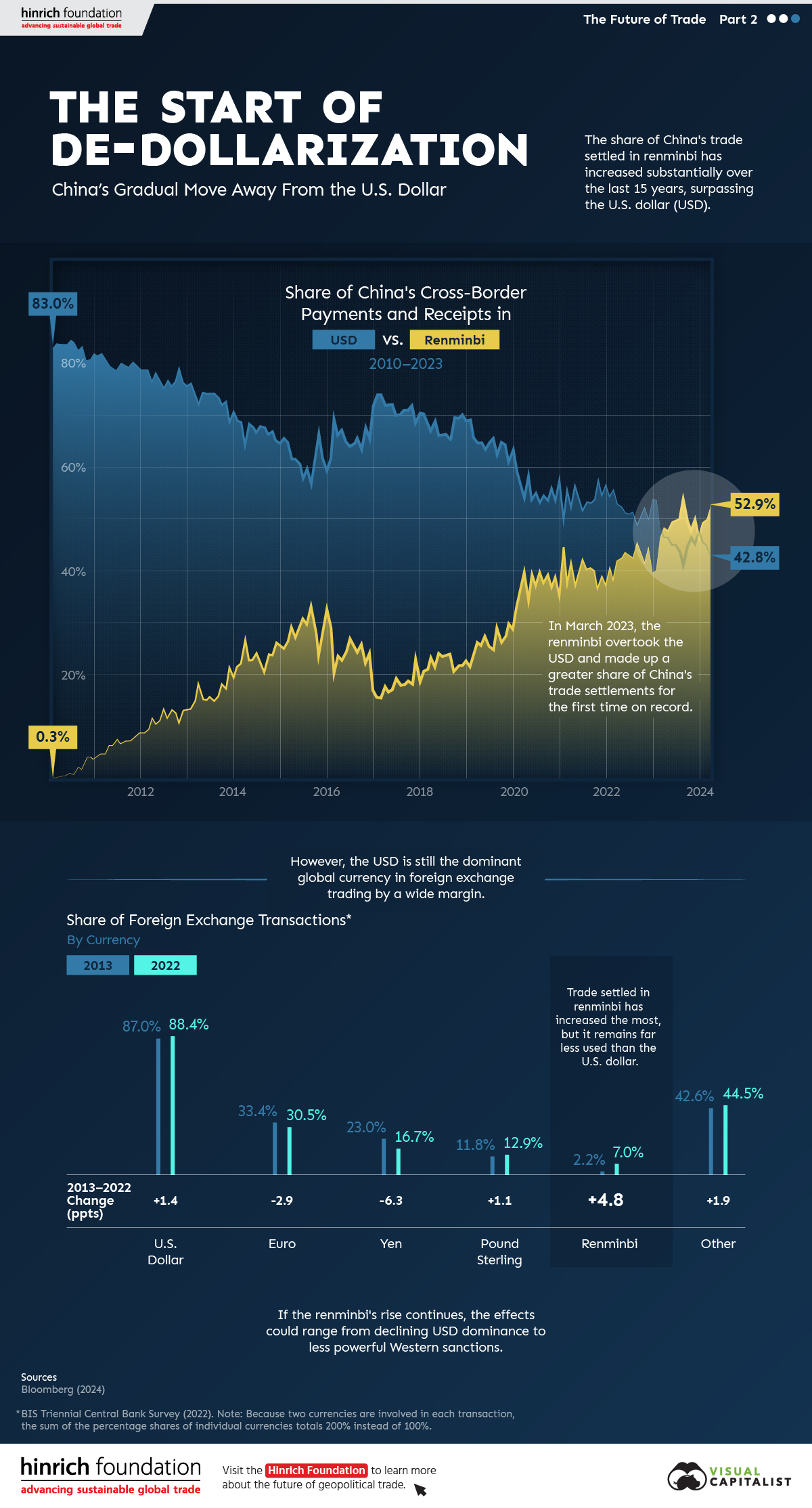

This is why Trump has been making horrific threats to BRICS about replacing the dollar. BRICS has reassured them it doesn’t intend to do that, but it’s not clear they aren’t lying and in any case, what BRICS has mostly been doing is changing from using the US dollar in trade to just using bilateral currencies. More and more, BRICS members trade with each other in their own currencies, without using the US dollar.

This chart, again from the Visual Capitalist, is worth staring at a bit:

As the chart notes, the US dollar is still #1, but that chart isn’t comforting. Remember that China, not the US, is the #1 trade partner of the most nations in the world. And note that while the US is China’s #1 export destination, exports to the US accounted for 2.9% of Chinese GDP, down from 3.5% in 2018. Eighteen percent of China’s exports went to the US in 2023.

The point, here, is that if you can’t sell to America because of tariffs, and if the US doesn’t have much you want to buy because China is cheaper, why do you need the US dollar?

If the US dollar loses privilege, if people won’t accept it because it can be used in trade with any country, then America has a problem: it can’t just print dollars any more and if it can’t print dollars any more, Americans can’t keep massively over-consuming.

This means a massive demand drop from Americans: they will have to consume much less. You might think that means an opportunity for American firms to step into the breach, but this will happen with very little demand from in the American market (and with the trade war, no one else is going to be buying from the US as their first, second or third choice.)

The American cost structure is high and American “capitalists” prefer to play financial games to make things. The American competency crisis is real, and not caused by DEI. The market has high barriers to entry, incumbents addicted to oligopoly profits and no basic machine industry and almost no basic electronic parts manufacturing.

The transition period will be ugly. Beyond ugly. Quite likely “economic collapse” level ugly.

There was a way to use tariffs and industrial strategy, but starting a trade war with half the world all at almost the same time was not the way to do it. You pick sectors (start with machine tools and basic electronic and machine parts), tariff that, put in subsidies and restructure the market for those goods. Once that’s going, you move back up the chain.

That’s how you use tariffs and industrial policy to reindustrialize.

Trump’s tariff plans are based on assumptions that are not going to hold in the real world, during a global trade war. Tariffs are important and often good and I support their use, but like everything else, they must be used intelligently.

Enough for today, we’ll talk about the effects (almost entirely positive) of Trump’s tariffs on everyone else in the world next. Trump is doing what no one else could: destroying the American empire and the neoliberal world order. I’m very thankful and as long as we can avoid war Trump’s actions are positive in the middle to long term for far more people than they’re bad for. Just, well, not Americans in the short to middle term or anyone who gets invaded.

More soon.