Over ninety-nine percent of economists did not predict the 2008 financial crisis.

The vast majority of economists were pro-globalization, by which I mean pro offshoring and outsourcing. They said it would be good for America, they were wrong.

China is predicted to wind up with over 50% of the world’s industry by 2030. Forget all the bullshit about great power competition. It’s over. There may be a war, but if there is one the West will either lose or the world will be destroyed in a nuclear exchange.

Back in the 90s an economist called Brockway liked to say “Economists are bad for your health.”

(If you like the writing here, well, support it if you can. There aren’t a lot of places like this left on the Web. Every year I fundraise to keep it going. Please Subscribe or Donate.)

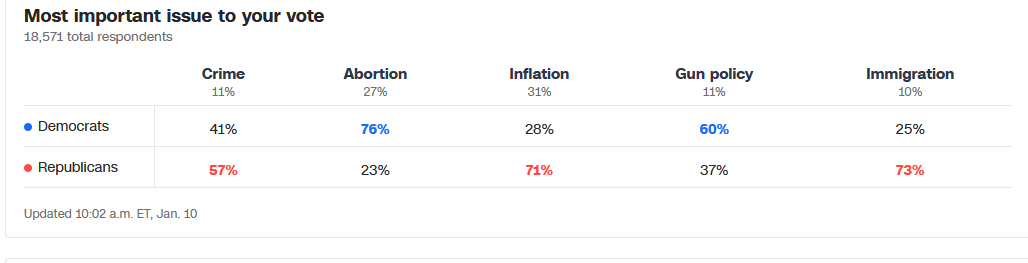

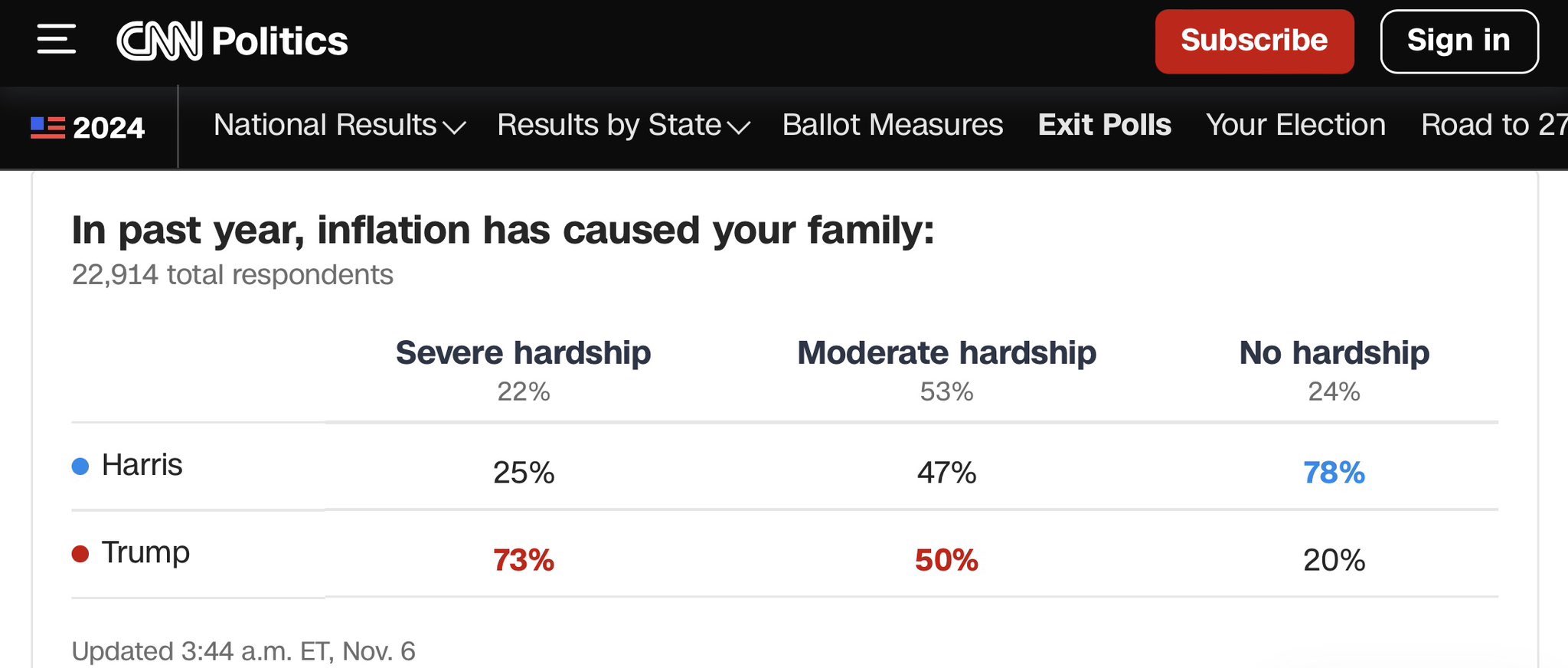

Let’s bring this back to the election. I thought that abortion would be the election defining issue. Stupid of me, though abortion was #2 and only four percent behind inflation. It was inflation, which given how much I write about it, I should have expected. Two tables from the CNN exit polls:

Abortion was the second most important issue. Inflation was #1, and people who voted for pro-abortion measures voted about 9% less for Harris.

Economists meanwhile keep talking about the #Vibecession: the idea that there is no recession, people just think there is.

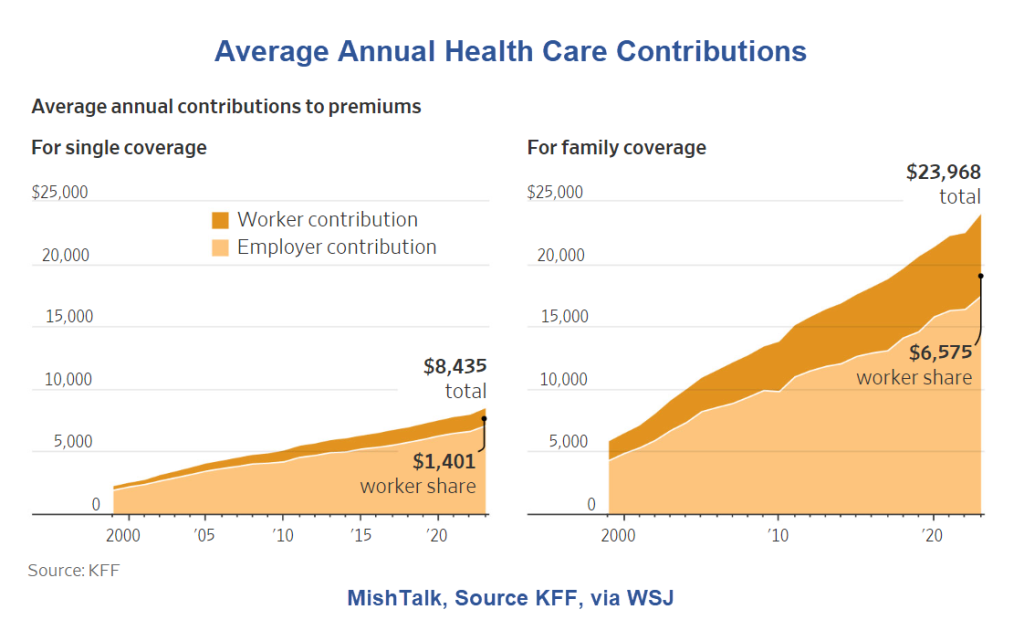

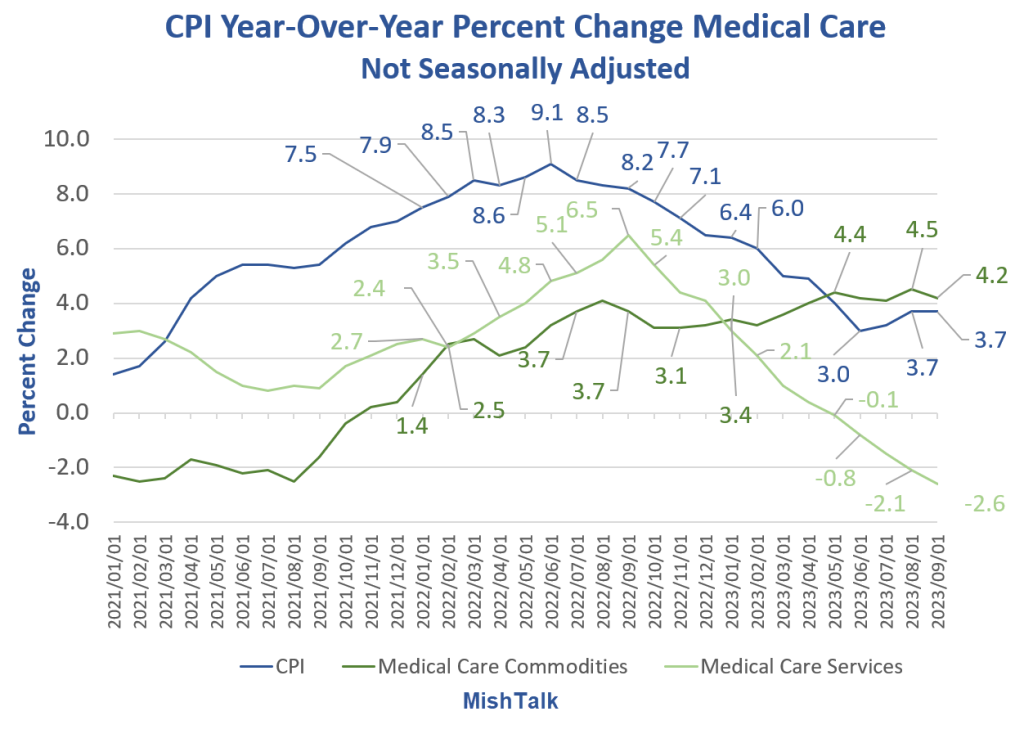

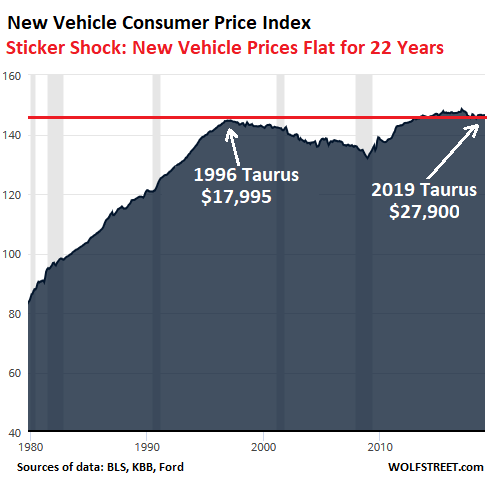

Economists, as usual, are full of shit. They have a professional dependence on official statistics and refuse to realize that many of them don’t reflect reality. As I have written in the past, according to official inflation statistics the price of cards did not rise between 2000 and 2020. In another case, you will be happy to know that medical service costs are going down. Hedonic adjustments are completely out of control: prices are dropping, you see, because products are so much better now. (There are other finangles, this is the main one.)

Growth numbers are based entirely on nominal growth minus the inflation rate, as are real wage numbers.

I would bet that the US economy has been contracting since 2008, but since inflation is understated, it isn’t visible.

I would also bet that median welfare for Americans has been declining since somewhere between 1968 and 1979, though average might have been increasing till 2008 because of how much money was being shoveled to the rich and wealthy.

We live in a pretend world, and economists are the chief pretenders, the sycophants telling the Emperor how wonderful his new clothes are.

To riff on Galbraith, economists exist to make astrologers look good.

Economics, as a discipline, should be wiped from the face of the Earth. The less than 1% of economists who aren’t charlatans or fools are not enough to justify the harm economists do, which exceeds even that of MBAs.

Harris lost because of the insistence of Democrats that the economy was good, inflation was fine, and that voters were too stupid to read their own grocery bills. Because of this belief Harris said she wouldn’t have done anything different than Biden did. What she needed to do was get out there and say she was going to drive down prices, especially rent and groceries.

As for Trump, we’ll talk more about the effects of his economic plans, if instituted, later.