What is geopolitical risk, you ask, and the Saudis answer:

Saudi Arabia warned it could sell off some European debt holdings in retaliation to a move by the G-7 to seize almost $300bn in frozen Russian assets, according to a report by Bloomberg.

The veiled threat was passed along from Saudi Arabia’s finance ministry earlier this year to some G-7 counterparts, as the group weighed seizing Russian assets designed to support Ukraine.

Saudi Arabia specifically signalled out the euro debt issued by France, according to Bloomberg.

Riyadh has been concerned about western efforts to seize the Kremlin’s assets for months. In April, Politico reported that Saudi Arabia, along with China and Indonesia, was privately lobbying the EU against confiscation.

Notice that Indonesia is also involved. China is less surprising, they know that freezing and even confiscation is in the cards for them when things heat up between the West and china.

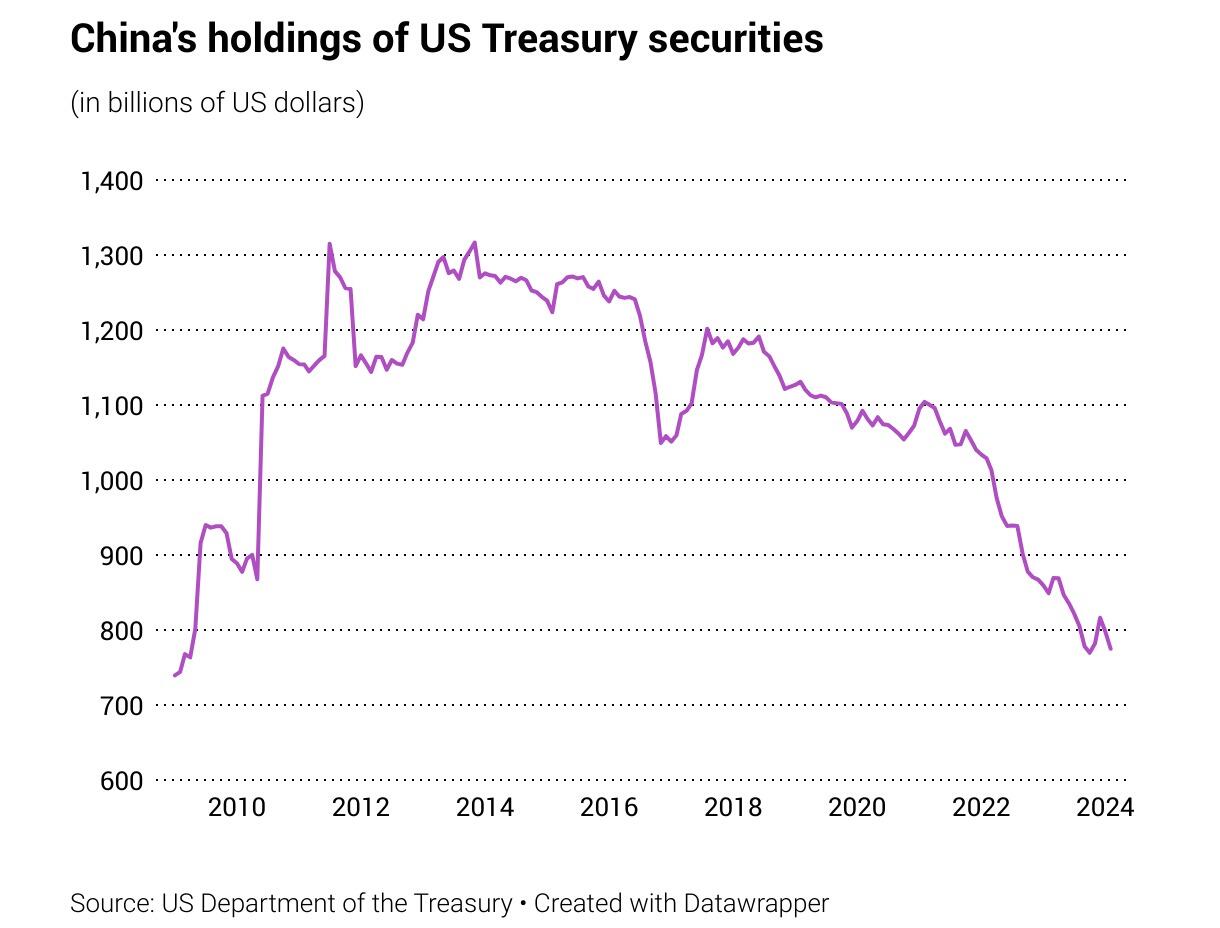

China has been reducing its risk:

Edit: (Or perhaps they aren’t?)

No one wants to do business with nations that will simply take away their money. Freezing was bad, but normal. Seizure is not. Since no one seized or freezed America’s overseas assets when it invaded, say, Iraq, and no one ever seizes or freezes West European assets, it might be thought that this isn’t about “law” but about “power.” For that matter, why haven’t Israel’s overseas assets been seized?

The level of geopolitical risk from doing business in the dollar or using the Western banking system is just too high. Freezing, seizure and sanctions, plus the US applying its law extra-territorially simply because a transfer happened to go thru an American bank even though the sender and end party were both outside of America.

This abuse is long-standing, you can read accounts from the fifties, but it really picked up in the 90s. Indeed there’s an entire book, Treasury’s War, about the phenomenon.

And this is what all the economists and similar pundits who go on about how the dollar can’t be replaced don’t understand: that they are right that the costs of replacing the dollar are significant; that it’s hard, and that it’s not really worth it.

Except it is worth it, because if the cost of trade and money transfers goes up slightly under a non-dollar regime, and even a slight increase is massive when multiplied by the number and amount of transactions, it’s still worth it because of the massive reduction in geopolitical risk. And nattering on about how the Yuan can’t be used because the Chinese can’t accept the costs of using the Yuan is stupid: that’s not what the BRICS are trying to do: the idea is to create a central, multinational currency, and to simply use local currencies whenever possible, while avoiding the Western banking system entirely.

Everyone knows that the dollar and the Western banking system are guns, and that everyone who uses the dollar and the Western banking system are under those guns and can be hit at any moment if D.C. or Brussels desires it.

When this was hardly ever done, it was a risk worth taking. When China was the main industrial power who you could buy almost everything you wanted from, and the West was the only option for most technological goods, well, you had no choice.

But now nations see a way out from under the guns, and they’re going to take it, even if it costs them, because the potential cost of not doing so is catastrophic.

I don’t want to spend a lot of time on this, but the fundamentals are worth a quick review.

I don’t want to spend a lot of time on this, but the fundamentals are worth a quick review. As you’d expect from the title, both more and less than it seems.

As you’d expect from the title, both more and less than it seems.

Recently, the Chinese Communist Party proposed removing the normal ten year limit on how long someone can stay President.

Recently, the Chinese Communist Party proposed removing the normal ten year limit on how long someone can stay President.