Trump backed off on most of his tariffs after Japan sold a ton of bonds and he panicked. He replaced most of the tariffs with a blanket 10%, and kept tariffs on China and Canada (because those countries had counter-tariffed the US, supposedly.) Now the report is that what US negotiators are demanding is that in exchange for avoiding US tariffs, other countries tariff China.

It should be noted, first, that China will not back down. The way Trump is framing this is “China will come to us” and sub-voce “beg” and that’s not happening, it would be a massive loss of face for Xi and for China and China is a “face” society. So massive tariffs on both sides will continue unless the US makes the first overtures and in a face saving way. The US rates on China are 125% and the Chinese rates on America are 85%.

These are nuclear levels and are going to bring trade damn-near to a halt. China has also put export bans on a number of companies for “dual use” techs: in practice, they’ve hit Lockheed and Boeing (big military aviation companies) so hard that I’m not sure those companies will be able to build planes, the supply chain is that China-centric and there are no alternatives.

(Aside: the criminally minded will be scrambling to smuggle into the US, and fortunes will be made, as they were during Prohibition. Those who wish to reduce criminal risks can just import Chinese goods to Canada and Mexico and sell them to whomever. “I don’t know officer, I don’t ask them why they want all those machine parts. Not my business.”)

It’s hard to say how this will play out, because:

- Lots of western countries have a hate-on for China. European and Canadian politicians, early on in Trump’s regime, had suggested “why tariff us, let’s go after China together!”

- But… that was then, and this is now. A lot has changed in three months. No one trusts Trump to keep deals any more and China is looking mighty stable. Even if you’d really rather do business with the US, like Europe, can you expect any deal to be kept?

I’m genuinely unsure how this will play out. My personal preference would be to tell the US and Trump to pound sand: they don’t keep their deals, so you just can’t do business with them no matter what the theoretical case is. (That case is mostly that it’s hard to compete with China, their goods are so cheap, whereas the US is sclerotic so you can sell them stuff, especially if they’re in a trade war with China and can’t buy cheap: charge them 2x as much and still come in under!)

If Trump had gone for this as the start, he would have gotten it. Canada and Europe would have fallen over themselves to join in. Now? Not so sure.

There’s a lot of “Trump is a genius and there is a PLAN” going around in MAGA circles. Bullshit. If this was Trump’s actual goal, what he did made it harder to achieve rather than easier. What actually happened is that Japan jerked the bond market’s chain and Trump backed down and is trying to pivot.

It’s not a completely stupid pivot, the West isn’t competitive against Chinese manufacturing, and one way to deal with that (a bad way, but still a way) is to just cut China out of Western markets and sell over-priced goods to each other.

Years ago I said that the way geopolitics were playing out was leading to a “New Cold War” — there’s an entire category on this blog, just on that.

Crunch time has come and we’ll see if it happens, and who’s on each side. Trump’s made America’s chances of putting together a strong coalition far weaker than they should have been, but anti-China fear and a refusal to end rentierism in the West mean that we can’t, actually, compete against China, so there’s still a strong temptation to form that anti-China bloc.

If so, we’ll be the weaker side, as the USSR/Warsaw Pact was last time and we will lose the new Cold war, falling further and further behind technologically and watching as the Chinese enjoy goods we can barely even dream of, just as was true of the late Soviet Union.

Everything, and I mean everything, will be sacrificed to keep the oligarchs in power, keep making them richer and keep the flow of unearned cash pouring into every rich person’s orifices.

Update: Seems that the EU and China are in talks to end EU tariffs on electric vehicles. That sound you hear is Elon Musk puckering up to kiss his ass goodbye.

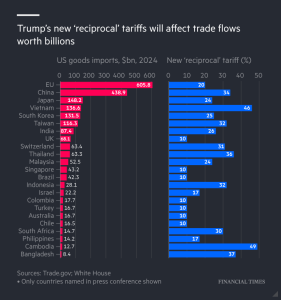

So, Trump’s tariffs are out. He claims they’re half of what each country tariffs the US, but in fact they appear to have been determined by dividing how much the US sells to a country by how much that country sells to the US.

So, Trump’s tariffs are out. He claims they’re half of what each country tariffs the US, but in fact they appear to have been determined by dividing how much the US sells to a country by how much that country sells to the US. The tariffs on each country should have been individually determined based on what America buys from them, and what America sells to them. If it’s something the US can’t make, or given opportunity costs shouldn’t make (do you want to build more power plants for AI, or use it for aluminum?) then those things shouldn’t be tariffed. And if you’re buying what you really need from them, and can’t make yourself or shouldn’t (Canadian potash and aluminum, for example) then why are you tariffing? The Canadian example is a good one: Canada imports more manufactured goods from the US than it exports to America. Tariffs encourage Canada to buy less goods and re-industrialize, reducing demand for American goods and encouraging American de-industrialization.

The tariffs on each country should have been individually determined based on what America buys from them, and what America sells to them. If it’s something the US can’t make, or given opportunity costs shouldn’t make (do you want to build more power plants for AI, or use it for aluminum?) then those things shouldn’t be tariffed. And if you’re buying what you really need from them, and can’t make yourself or shouldn’t (Canadian potash and aluminum, for example) then why are you tariffing? The Canadian example is a good one: Canada imports more manufactured goods from the US than it exports to America. Tariffs encourage Canada to buy less goods and re-industrialize, reducing demand for American goods and encouraging American de-industrialization.