Let’s deal with a common misunderstanding, that “dollar devaluation is going to save the US.” The idea supposes that if only the US dollar were low enough, the US would become competitive.

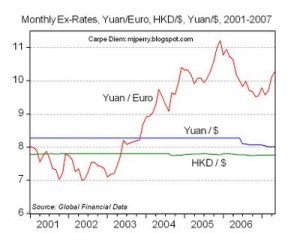

First, take a look at the charts to the left. The US dollar under Bush took a nosedive versus the Euro (and most other currencies as far as that goes). Note that the Yuan appreciates against the Euro, but not the dollar, during that same period.

Why is that? Because China spends a huge chunk of money keeping the Yuan pegged to the dollar. In some years, as much as 10% of their entire GDP.

During the Bush administration we had a massive experiment in devaluation. During the Bush administration ordinary people’s incomes went nowhere, and the era ended in a massive financial crisis.

Before that financial crisis something else interesting happened: there was a huge rise in the price of oil, up to $150 a barrel. (For much of the nineties it had been below $20/barrel.)

At the current time, if the dollar drops, the price of oil will rise.

An increase in the price of oil and other commodities will increases the trade deficit, because commodities need to be imported.

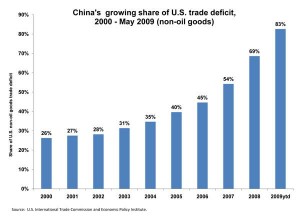

China is the largest source of the US trade deficit: between 2001 and 2009, China accounted for $1.58 trillion of the $3.81 trillion trade deficit (and the percentage increased throughout the period). China will make sure that there is no devaluation of the dollar relative to the Yuan.

Given that the Chinese proportion of the US non oil deficit is 83%, the effect of devaluing the dollar on trade deficits will be essentially zero.

The end effect of dollar devaluation, then, is an increase in the price of oil and other commodities which increases the trade deficit, but has no effect on imports from China.

Given that devaluing the dollar will also lead to an increase in the price of oil, it is entirely likely that it’s net economic effect will be negative, rather than positive, as the US economy shakes apart under exorbitant oil prices. In 2008 the economy shook apart at about $150/barrel. Despite the current lousy economy, the price of oil is now over $70/barrel.

“Right then,” you say. “Let’s force the Chinese to stop spending all that money keeping the Yuan overvalued relative to the dollar! If they won’t, let’s slap countervailing tariffs on them!”

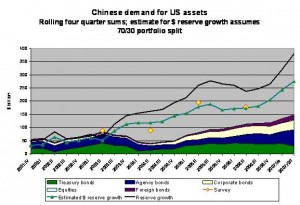

Great idea. Except that China’s need to keep the Yuan overvalued against the dollar is why they buy up US treasuries and other US assets. If they can’t keep the Yuan overvalued against the dollar, and therefore maintain access to the US consumer, then they have no need to inflate the value of US currency. Or to put it another way, what happens if China says “Ok, we’ll stop buying US treasuries and other US assets to keep the Yuan up.”

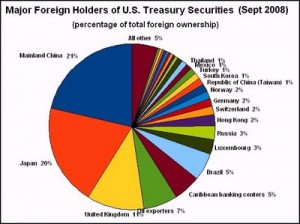

Question: Who is funding the US government and agency deficit right now?

Answer: China and Japan.

Japan’s new government is very likely to start buying a lot less US debt, because Japan’s trade surplus with the US has been shrinking despite massive currency intervention. That leaves China.

The chart on the left only goes to 2007, since then the US government deficit has rocketed to the highest level in history.

What would happen if China decided to buy a lot less American debt, including US government debt?

- US debt servicing costs would climb through the roof, massively increasing the deficit and putting even more pressure on domestic programs.

- The US dollar would indeed collapse, and not just against the Yuan. The Chinese ceasing to buy US assets (or even decreasing significantly their purchases) wouldn’t just effect Yuan/dollar rates.

- The US trade deficit to China would drop, but it would still not be reversed. (China’s costs are legitimately lower than America’s, although China’s productivity is also lower.)

- Inflation would increase significantly. Cheap imported goods have been an engine of deflation for some time now; increasing their price could lead to inflation, especially if there were also a spike in oil prices at the same time. The corollary to increased inflation is a decline in the US standard of living, even if there isn’t an inflation spike (because that would mean a reduction is goods being bought or an economic shock so severe it lead to a deflationary spiral).

If China let the Yuan appreciate to its natural value against the dollar, it would almost certainly throw the US, and the world, into another financial crisis. It would also badly damage China’s economy, which would lead to more riots and instability in China. The advantage to China would be that they could buy oil for much much less than before, and that oil prices for the US would rise (though such a rise might be choked off by a collapse in the world economy). However, any real recovery in the world economy would leave the US with permanently higher oil prices and China with lower oil prices, in itself a competitive disadvantage for the US.

The results, in short, would likely be disastrous. Maybe even catastrophic. On a global scale.

Right now, devaluing the US dollar does nothing for the US. A forced radical devaluation by making China end its peg would probably be disastrous for the US.

The route to prosperity does not run through a dollar devaluation. Or rather it doesn’t run directly through a dollar devaluation. There are things which need to be done first, before the dollar is allowed to float to its natural level.

- Radically reduce the US dependence on oil imports.

- Radically decrease unproductive spending, including military spending and health care spending (by which I don’t mean cutting medicare, I mean taking back the 5% of wasted GDP spent by the private medical industry) .

- Significantly increase progressive taxes so that the US does not need as much foreign funding.

Since all of those things are third rails in American politics, as we’re seeing now in the health care debate, where a real restructuring of the industry is not even on the table, the US will not escape from the trap it’s in.

In part, the lack of effective and politically viable policy options is because the US political system is broken. (For example, most of the population is in favor of single payer health care, yet this option isn’t even on the table.) In part, it is because America’s citizens want the status quo to continue. After all radically progressive tax increases, cutting the military budget in half or enforcing 55 mile an hour speed limits and putting city cores off limits to most cars aren’t just unpopular with politicians, they’re unpopular with the population as a whole.

America, and Americans, want to live beyond their means. They don’t want to make hard decisions. And the political system doesn’t want to take money away from any powerful interests which benefit from the current system. So the American eagle will remain trapped, dying by inches, because no one is willing to do what it takes to save America from itself.

tjfxh

Good analysis, Ian. I would only add that a big reason for the US monetary authorities’ wish to devaluate is to force the excess liquidity they are creating into assets, specifically equities and housing. Therefore, the explosion in equity prices in tandem with the dollar sinking and without any explanation in term of changes in the fundamentals. Similarly, a floor is being established in the housing market by “investors” buying up foreclosures to rent until they can be flipped. What the Fed wants to do is by this is (1) reflate toxic assets and (2) restoke the wealth effect to reignite consumer spending. But as assets reflate, so does other tangible wealth like commodities — oil, gold, sugar etc. are doing very well.

Is there a way back to 2007 through reflation/devaluation? Apparently Ben, Tim , and Larry do.

tjfxh

FLASH: ZeroHedge: Head Of China Sovereign Wealth Fund Openly Admits Asset Bubble Addressed By Creation Of More Bubbles

Mandos

Your argument pivots around the price of oil. It may still be the case that the price of oil is inflated due to speculation. Also, it’s hard to see how, given recent history, oil prices could rise as the US consumer’s spending ability declines, except insofar as Chinese demand takes off, which means that this scenario (of oil price increases wiping out the gains from dollar devaluation) would have to be extremely carefully timed to occur. That is, if devaluation is what the USA is seeking/will eventually seek as a policy.

tjfxh

Mandos, the price of tangibles like oil is not only a function of demand resulting from economic expansion and speculation but also as a store of value in uncertain times and a hedge against devaluation as well as inflation.

The dollar devalues relative to other values. These values are not only other currencies but tangible assets. This is why dollar devaluation not only increases exports and decreases imports, but also creates at incentive not to hold dollars, which are losing value against equities, RE, and other tangibles. The Fed would like people to be switching from cash to equities and RE to reflate these assets, but many people are wary that the Fed is just creating another bubble there and they are looking elsewhere to park more safely. Moreover, holding US interest rates low is creating excess liquidity and a carry trade, further misallocating capital, since little of it is being committed to productive use. Some of that is fueling speculation in commodities.

In short, by creating liquidity, monetizing debt and absorbing toxic paper, the Fed can led the horses to water but it cannot make them drink. These policies have unintended consequences, which are not entirely unforeseen. There is another big bubble being blown as we speak, as the Chinese just admitted (see link above). When this one bursts, who is going to bail out the Fed? The Treasury? That’s why gold is doing well even in a deflationary environment. Gold is not only a hedge against inflation, but also currency chaos and government default. This is not looking good at all.

tjfxh

More evidence that capitalism is not working.

Anti-speculation push may topple oil prices

Of course, it will topple exploration, too, leading to supply problems down the line. Oh, those damn unintended consequences.

Ian Welsh

Mandos,

any recovery, no matter where in the world, or in what sector of the economy, will lead to increased oil prices. If there is no real recovery it won’t be strangled by oil prices, of course. But in that case, well, errr, there’s no real recovery.

Of course, anti-speculative limits may limit oil price increases (a lot was due to speculation) but not as much as folks think, if the US dollar declines, because the oilarchies will take it out the other end even if traders aren’t there to drive up the prices like they did in the last oil bull run.

I’m not against anti-speculative curbs on oil prices, actually. It’s a necessary step.

Ian Welsh

Speculative curbs: depends if they get /everyone/ onboard. Short limits last year, for example, only hit the non-professionals. I had a friend who could still short by going through Shanghai, for example.

So we’ll see… If even one exchange capable of handling volumes remains open, it won’t work. And if I were, say, Dubai, I wouldn’t see any reason to cooperate.

Pete Murphy

Currency valuations have almost nothing to do with the U.S. trade deficit. Since leading the global drive toward trade liberalization by signing the Global Agreement on Tariffs and Trade in 1947, America has been transformed from the wealthiest nation on earth – its preeminent industrial power – into a skid row bum, literally begging the rest of the world for cash to keep us afloat. Our cumulative trade deficit since 1976, financed by a sell-off of American assets, exceeds $9.4 trillion.

I am author of a book titled “Five Short Blasts: A New Economic Theory Exposes The Fatal Flaw in Globalization and Its Consequences for America.” My theory is that, as population density rises beyond some optimum level, per capita consumption begins to decline. This occurs because, as people are forced to crowd together and conserve space, it becomes ever more impractical to own many products. Falling per capita consumption, in the face of rising productivity (per capita output, which always rises), inevitably yields rising unemployment and poverty.

This theory has huge ramifications for U.S. policy toward population management (especially immigration policy) and trade. The implications for population policy may be obvious, but why trade? It’s because these effects of an excessive population density – rising unemployment and poverty – are actually imported when we attempt to engage in free trade in manufactured goods with a nation that is much more densely populated. Our economies combine. The work of manufacturing is spread evenly across the combined labor force. But, while the more densely populated nation gets free access to a healthy market, all we get in return is access to a market emaciated by over-crowding and low per capita consumption. The result is an automatic, irreversible trade deficit and loss of jobs, tantamount to economic suicide.

One need look no further than the U.S.’s trade data for proof of this effect. Using 2006 data, an in-depth analysis reveals that, of our top twenty per capita trade deficits in manufactured goods (the trade deficit divided by the population of the country in question), eighteen are with nations much more densely populated than our own. Even more revealing, if the nations of the world are divided equally around the median population density, the U.S. had a trade surplus in manufactured goods of $17 billion with the half of nations below the median population density. With the half above the median, we had a $480 billion deficit!

Our trade deficit with China is getting all of the attention these days. But, when expressed in per capita terms, our deficit with China in manufactured goods is rather unremarkable – nineteenth on the list. Our per capita deficit with other nations such as Japan, Germany, Mexico, Korea and others (all much more densely populated than the U.S.) is worse. My point is not that our deficit with China isn’t a problem, but rather that it’s exactly what we should have expected when we suddenly applied a trade policy that was a proven failure around the world to a country with one fifth of the world’s population.

Ricardo’s principle of comparative advantage is overly simplistic and flawed because it does not take into consideration this population density effect and what happens when two nations grossly disparate in population density attempt to trade freely in manufactured goods. While free trade in natural resources and free trade in manufactured goods between nations of roughly equal population density is indeed beneficial, just as Ricardo predicts, it’s a sure-fire loser when attempting to trade freely in manufactured goods with a nation with an excessive population density.

If you‘re interested in learning more about this important new economic theory, then I invite you to visit either of my web sites at OpenWindowPublishingCo.com or PeteMurphy.wordpress.com where you can read the preface, join in the blog discussion and, of course, buy the book if you like. (It’s also available at Amazon.com.)

Pete Murphy

Author, “Five Short Blasts”