Top Tax Rates

—And thus, inability to run the state.

In the modern world this causes a great deal of confusion. I guarantee some MMT follower is gleefully planning a comment saying “a state’s ability to spend is not based on taxation.”

Technically true, practically false. A state which uses its own currency can always, in theory, print money.

But taxation is best understood more primaly than “the people send us money, we spend it.” Rather it is the amount of the economy which the government can control.

Every country has an economy. The economy is what the people of the nation actually do. Dig stuff up, refine stuff, grow stuff, manufacture, stuff, take money from idiots as consultants, waste everyone’s time with advertisements, destroy the digital commons, and so on.

Near adjacent to the economy is what it could do if we wanted it to, because we know how to do whatever it is and we can easily get the resources: so we could easily build more homes, for example, or train more doctors or nurses, or hire more Professors or build out more solar power and so on.

The final part of the economy is what you can get from other nations. Call this the external economy. Does someone else make it, will they sell it to you, can you afford it? Most of the time countries won’t sell other countries nukes, for example, and for much of history countries tried not to sell other countries the knowledge required to make advanced techs. When they didn’t prevent this, they paid big time: Britain was de-facto subjugated by America and America is now losing its Empire.

The final part of the economy is what you can get from other nations. Call this the external economy. Does someone else make it, will they sell it to you, can you afford it? Most of the time countries won’t sell other countries nukes, for example, and for much of history countries tried not to sell other countries the knowledge required to make advanced techs. When they didn’t prevent this, they paid big time: Britain was de-facto subjugated by America and America is now losing its Empire.

This is why being the richest King in Africa in 1850, even if you had been richer than England, would have done you very little good. You could not buy what you needed: industry, and even if you could buy a few weapons and machines you couldn’t maintain and repair them.

Taxation is the ability to command the resources of other people. That is all it is.

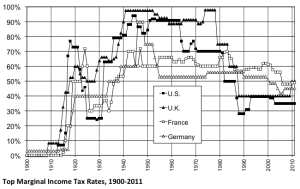

Now, in the US and the West generally, since some point in the sixties, the state has been increasingly losing the ability to tax the rich. The rich insist on controlling more of the nation’s wealth and economic activity and every decade they have increased that control. Every time something is privatized, that’s the state losing power to tax—to control a piece of the economy. Every tax decrease on the rich is, obviously, a reduction in ability to tax the rich.

The amount of control the State has has been reduced, and amount of control the rich have has been increased. This is an effective loss of the ability to tax.

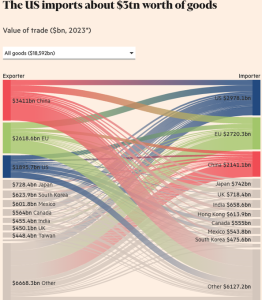

What is happening right now is that the US is losing the ability to tax the rest of the world. Dollar privilege was “we’ll take American money and make what Americans want for them.” It was the ability of America to direct other people’s economies to do what America wanted. The vast power this implies is mind-boggling.

It is that ability to control other nations’ economies which made the US an Empire, even if it directly militarily occupied few countries. It didn’t need to. It could still tell them what to do.

Since the US didn’t need to make and dig everything, it didn’t: it just made everyone else do that. This was, in many ways a bad idea, but it did mean that the US got the benefits of industry without a lot of the downsides.

So, since JFK and especially since Carter/Reagan, the US has been losing its ability to tax the rich. It has increasingly chosen to tax the rest of the world, moving industry, in particular, to other countries. Those countries made what the US needed, and sold it to them in US dollars, of which they were willing to accept nearly infinite amounts even though, in most cases, they didn’t need nearly as much from the US as the US did from them. (What they did need, in the early and middle years, was capital goods and knowledge, almost infinitely precious, though. Now with China leading in 80% of fields, well, not so much.)

Right now a huge tax cut for the rich is being paid for by cutting 800 billion from Medicaid, even as DOGE savagely cuts a federal civil service which has not grown in nominal numbers in sixty years, and thus has really already been contracting. State capacity is being savaged and services and jobs are being removed from the lower and middle classes.

Now let’s bring this back to the original topic: revolutions happen when states can’t command enough of the internal or external economy. It does not matter how much you can print or tax in nominal terms. In the Weimar Republic people would take a wheelbarrow full of cash to the store: all that matters is what you can actually command/buy with the money. For a long time the US dollar could buy pretty much anything.

But what happens when it doesn’t? What happens when you give it to cops and bureaucrats and soldiers and brown shirts like ICE and it doesn’t buy what they need, or even what they want?

different clue

People were “moderated” right off of Naked Capitalism for not worshipping the MMT

(Magical Monetary Thinking) Cargo Cult worshipfully enough. Or, even worse, for making fun or even just seeming to make fun of some of its most revered High Priests.

Magical Progressives believe that if they can just get their hands on the magical MMT money-issuance-and-spending machine, that they can magically MMT their way into the Progressive Society.

different clue

A thought suddenly hit me . . . what if Trump is a secret Manchurian Marxist? What if he has been for decades?

What if he has decided that the State will never wither away the way Marx said it would at the Dialectical Materialistian End Times? What if Trump has decided to MAKE the State wither away Right G@dDamn Now? By Burning it the F@ck Down!?

bj

@different clue

Imagine that the founding myth for your theory on money was that taxation drives your money’s value (MMT) and people so misunderstand your theory as to say things like taxation doesn’t matter. Ian writes an almost MMT treatise besides the opening paragraph from how developing economies need dollars to the power of taxation to drive the productive capacity of the economy. NakedCapitalism convinced me of MMT and when people tell me they don’t want to pay tax, I reply, “Oh you want your money to be worthless?”. In fact, MMT academics have been screaming that the US has so much outstanding debt that raising interest rates will drive inflation, so apparently even debt matters.

Joan

(Pointing out the obvious, sorry.) We are at a dangerous point right now because the president can order the enforcers (cops, ICE, the military) to do what he wants, whether it’s legal or not, and it seems right now the enforcers are happy to obey.

Ahmed Fares

“I guarantee some MMT follower is gleefully planning a comment saying “a state’s ability to spend is not based on taxation.””

Hi, I be that MMTer. However, I’ll spare you the MMT speech and say something even more profound:

It is impossible to tax rich people.

The function of taxes is to release resources, not money. After all, the issuer of a fiat currency has no need for money. Given that rich people have a low marginal propensity to consume, which is to say they won’t cut back on spending when taxed, the money you get from them when spent will cause inflation. This will cause the central bank to respond by raising interest rates, the so-called “monetary offset”, which will increase the flow rate of debt service payments to the very rich people you just finished taking money away from. In essence, the money you take from the rich boomerangs right back to them.

Monetary policy is a stealth tax on the poor. Fiscal policy sends money from the rich to the poor, monetary policy sends it right back in the other direction. Increase one, and you increase the other in the same amount. Like a blood circulatory system.

If you want to help the poor, what you require is a broad-based consumption tax, because that is what releases resources. This from Matt Yglesias:

“I do see the view, from a standpoint of abstract cosmic justice, that it’s annoying to see someone like Elon Musk or Jeff Bezos get so rich without contributing more to the Treasury. So there is a case for taxing wealth or unrealized capital gains or at a minimum changing the stepped-up basis rule. But fundamentally, I do think there are profound reasons why things like VAT and payroll taxes are the workhorses of European welfare states. Musk is not employing 10,000 butlers who can be taxed away and turned into preschool teachers. Inducing him to liquidate financial assets and fork over the proceeds does not generate any real resources that are available for new use. What a Nordic-style tax system does is broadly constrain consumption in order to free up resources for more extensive consumption of health, education, and other social goods.”

It’s all about resources.

Ian Welsh

Ah yes, the period when the West taxed rich people at over 90% marginal tax rates also had inflation higher than wage increases.

No.

And please never, ever, quote Yglesias except to mock him. I come out of the same circles as Matt, and he’s a dishonest careerist whose brand of intelligence is primarily oriented around knowing who to kneepad. (He’s a world leader in that type of intelligence, to be fair.)

Soredemos

@different clue

MMT is an objectively accurate description of how the accounting flows of how a fiat currency issued by a central bank works, woth a particular focus on the US.

If you’re run out of an economics blog for now honestly engaging with it, I would suggest that would be a bit like being run off a site related to geology because you refuse to accept plate tectonics. Some things just have such a preponderance of evidence that they simply are, beyond any reasonable doubt, true. And if you claim they aren’t, you damn well better bring receipts to back up your position.

MMT is even more clear cut a case because it’s about any entirely man made system. It’s not about some natural mystery. And if all you do is poke fun at the ‘High Priests’ that tells me you’re not actually arguing with any of the concepts or facts.

About MMT and taxes though, I’ve never seen a single major advocate claim taxes don’t matter. Enthusiastic amateurs, maybe (MMT has plenty of those). But the Moslers, Keltons, Keens, etc, have always been very clear that a reasonably functioning tax revenue systems matters to a floating fiat currency for a variety of reasons. Just raising revenue for the central government isn’t one of them.

The money is ultimately simply invented on a ledger somewhere. That’s a fact. The theory part is what can then be done with this fact. It’s honestly frustrating to see someone dismiss this all as if it’s some sort of vague ‘they just want to ride the magical money train to a progressive society’ as if specific, detailed policy proposals haven’t been written that literally fill entire books. A key insight of MMT is that real resources and their distribution matter, not money. To pretend this isn’t the case feels extremely disingenuous and bad faith.

Adam Eran

The best explanation I’ve seen of the limitations of MMT:

https://youtu.be/C33RWFYec3A

Political economist Mark Blythe explains why an independent Scotland has a problem, even if it’s a monetary sovereign.

mago

Just to jump on the dog pile, back in the halcyon days of the blogosphere, circa 2010 or so I used to read Yglesias and considered him a seer of sorts.

It didn’t take long to see him and the promising blog world transform into a pile of steaming shit.

Yglesias and his ilk aside, glad to see some torchbearers endure.

A bow to our kind host.

different clue

@Joan,

I suspect you are correct about most-at-least of the nation’s 18,000 police departments. I am sure you are correct about the ICEnazi magastapo.

I am not so sure about the military, or at least all parts of it. I have read that there are some unhappy campers in uniform, given how they would know they would be treated for blowing opsec the way the Hegseth gang has blown it, two times in a row now.

https://www.reddit.com/r/technology/comments/1k4os8q/white_house_plagued_by_signal_controversy_as/

And I think Hegseth himself had his doubts about automatic military obedience, as revealed by his very early firing of all leading JAGs.

https://www.newsmax.com/newsfront/hegseth-jag-fired/2025/02/24/id/1200325/

So Hegseth felt he had to take steps to make sure that the Armed Forces would indeed be Trump’s Christianazi Armed Forces when called upon. Can Hegseth be sure? Can he be sure that he can be sure? I don’t know. I would not want to be anywhere relevant if/when Hegseth gives the order, but still . . . can TrumpenHegseth be sure?

GregL

You’re distorting the MMT position. MMT just points out that the spending comes first and the taxation comes afterward. MMT does indeed say that if the state can’t tax effectively, ie, exactly the failed state you predict, inflation-to-hyperinflation will result.

Trump’s gutting of the IRS might get us there!

Warren Mosler, for his part, recommends eliminating payroll and incomes taxes and implementing a property tax to avoid the loopholes which the wealthy can easily exploit. (Of course our political system will never allow such a change, so it’s all moot).

There is definitely criticism of US policy to be made about the way that the US exercised its “exorbitant privilege” post-Bretton Woods. MMT would say that they (all US political leaders since 1944 until present day) have no idea how the machine they are operating actually works….and thus the results have been increasingly piss poor.

I think the answer to your wrap up question is: we become Great Britain.